Two of the Best Tax Free Investment Options

Learn the facts about 529 plans and Health Savings Accounts and how to use these tax free investment options to save thousands

This article is the second part in our series on saving money on taxes. It follows yesterday’s monster guide on the best retirement plans to meet your financial goals.

I wrote the two articles as one guide but, honestly, the website software I use was having trouble handling 17,000+ words in one article!

So I broke the article in two but it’s really all about getting free money with some of the best tax savings strategies…legal ones anyway.

I have advised wealthy clients and institutional money managers and can tell you, there is no better investment than the one that comes with tax savings. Wall Street analysts work 80+ hours a week to beat the market by a percent or two, if that.

The tax-free retirement accounts yesterday and the two tax-advantaged savings accounts we’ll talk about today give you an instant double-digit return on your money through saving on income taxes. The 529 plans and Health Savings Accounts we’ll talk about today are even better, giving you a triple-tax savings!

Saving on Taxes for the Things You Need Anyway

Some people will say that saving money on taxes through special spending accounts isn’t really investing and shouldn’t be in an investing course…I say money is money. I consider it an investment when I put money away in a spending account for use later, especially when I know I will get a return on that money.

These tax-free investment accounts give you tax breaks on money that you need to spend anyway on medical expenses or education. You can get the money taken out before taxes on your paycheck or take a deduction on your income taxes to get the same benefit.

I’ll cover two special spending accounts here, a 529 education plan and a Health Savings Account (HSA). Both of these plans are critical to get the most out of your money and minimize the amount you owe Uncle Sam each year.

Saving money on taxes is easy with these tax-advantaged accounts and TurboTax software. It’s the online tax tool I use each year and easy to get all the tax savings you deserve.

Tax Free Investment for Education

529 savings plans offer some of the best tax savings in the list of tax-advantaged accounts. Whereas an IRA gives you an instant tax savings and tax-free investment growth until you withdraw the money, investments in a 529 account can be taken tax-free as well.

It’s a triple-tax benefit!

What is a 529 plan?

A 529 plan is special investment account allowed by a state or educational institution. The reason why it’s called a 529 plan is for the section of the tax code under which it’s formed.

Where a 401K or an IRA is for retirement investments, a 529 plan is an account specifically designed to pay for educational expenses. Plans differ by state but generally you can deduct the money you put in a 529 account from your state income taxes. Just like a 401K plan, 529s give you a list of investment funds in which you can invest your money and your investment grows tax-free.

If you withdraw money from your 529 plan for qualified educational expenses, we’ll cover what those are in a minute, then you don’t have to pay taxes. That triple-threat tax savings is a big advantage of 529 plans even over some of the retirement plans we’ve covered.

These kinds of tax-free investments will go further than any other money you have in a regular investing account. They’re my favorite ways to invest that really stretch your dollar and help reach your financial goals.

As with a 401K plan set up by your employer, 529 plans can vary depending on the state or institution that forms them. This guide will answer the most common 529 questions but consult your plan’s documents for specific rules.

Why should I put money in a 529 plan?

You will still have to pay federal income taxes on your 529 contributions but most people get a state tax deduction. The other tax benefits, tax-free growth and withdrawals, makes 529 accounts the perfect way to save for education.

Unlike retirement accounts, there’s no age requirements for withdrawing money from a 529 account. The only requirement is that the money be used for qualified expenses.

So obviously a 529 plan is better than just saving for education expenses in a regular, taxable investing account. You get that triple-tax advantage with the 529 account that you won’t get just putting your money away. There’s also a strong argument for having a 529 account besides your retirement accounts like a 401K and an IRA.

- While you can withdraw money from a retirement account to pay for educational expenses, it will throw your retirement planning off. It’s easier to keep retirement planning and planning for educational expenses separate with two different accounts.

- Taking money out of a retirement account for educational expenses will still be taxed as income. That’s money you could be saving with the tax-free withdrawals of 529 accounts.

- There’s no required minimum distributions on 529 accounts and you can change beneficiaries. That means you can continue to benefit from the tax advantages well past retirement and pass the beneficiary status on to your grandchildren.

Can anyone open a 529 plan?

529 accounts are typically limited to U.S. citizens or legal residents that are at least 18 years of age or with parental consent. A trust, estate or another organization can also set up a 529 account but must have a social security number or tax ID.

Anyone can make a contribution to your 529 account though it may mean they have to pay a gift tax if the amount is high enough. Understand that if you contribute to another person’s 529 account, you have no further rights to that money and cannot control how it is invested in the account.

Who can be the beneficiary on my 529 account?

You can name anyone as the beneficiary to your 529 account but you can only name one beneficiary at a time. You can name yourself as beneficiary and use the money to pay your own educational expenses as well.

If you have more than one child or beneficiary for whom you’d like to pay for college, you can open multiple 529 accounts. This is also smart because the investments in your account might be age-based so you would want different accounts for different beneficiaries.

If the beneficiary is not in your immediate family, i.e. spouse or children, they may have to claim the aid on their next year’s taxes as income. It won’t be taxed as income but will affect their eligibility for financial aid.

Can I change the beneficiary on my 529 plan?

Most 529 plans allow you to change the beneficiaries on the account twice a year without penalty or taxes. This means you can keep the money growing in your account even after your kids have graduated from college. You can change the beneficiary to yourself or your spouse until you are ready to change it to your grandkids.

Do I have to use the 529 plan offered in my state?

You don’t have to use the 529 plan offered in your state. If you contribute to an out-of-state plan or to one set up by a school, you might not get the immediate income deduction for your state taxes but you will still get the tax-free growth and withdrawals.

There may be a benefit to opening a 529 account with another state’s plan, especially if you don’t have income taxes in your state or don’t need the deduction. Fees on 529 plans differ by provider so you might get a better deal by shopping around. It’s easy to find another state’s 529 plan with Google, searching for ‘state name’ and 529 plan.

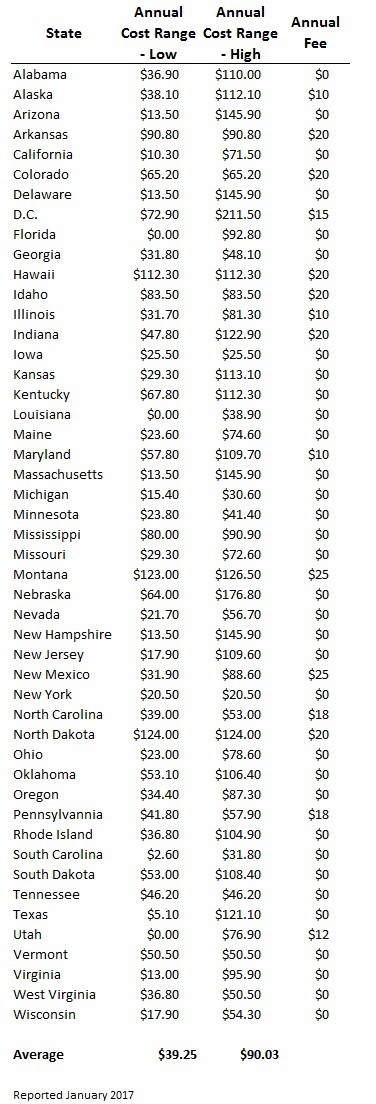

Each state with a 529 plan is required to report annually and disclose the cost of investing in the plan including fees and expenses for different periods from one to ten years. The costs are based on a $10,000 plan balance so may differ depending on how much you put in your account.

I’ve taken the reported ten-year costs for each state and divided by ten to show approximate annual costs. The low- and high-cost range will depend on which investments you pick within the plan, i.e. the annual expense charged by the investment managers. Some states waive the annual fee for residents and getting the lowest-cost may have restrictions like automatic monthly withdrawals from your checking account.

It’s important to read the restrictions on a state plan before opening an account. It might limit transfers to another 529 plan or one in another state. With the range in plan costs, it pays to shop around but that income deduction in your home state is generally going to be your best option if available.

Do I have to use my 529 money to go to school in my state?

No, the beneficiary to your 529 plan can use the money to go to any qualified educational institution. You can find the list of eligible colleges, universities and vocational schools here on the IRS website.

Is a 529 plan only to pay for my child’s education?

A 529 plan is only to pay for educational expenses but not necessarily your child’s. You can name anyone as the beneficiary so it’s got a lot of flexibility in how you can use the money.

What are qualified educational expenses?

The list of qualified expenses for which you can use 529 money is fairly broad. Generally you can use it for tuition, room & board, any fees set by the school, books and supplies (including computers).

If 529 money is used for anything other than these qualified expenses, you may have to pay income taxes and a 10% penalty on any earnings. Since you already paid federal taxes on the contributions, you don’t have to worry about taxes or a penalty on the contributions part of the withdrawal amount.

What happens if my kid gets financial aid or a scholarship?

If the beneficiary gets financial aid or a scholarship, then the amount of qualified expenses would have to be reduced and limit the amount you can pay with the 529 money. For example, if all the qualified expenses add up to $50,000 but the student receives $35,000 in financial aid then you would only be able to use $15,000 from a 529 withdrawal to pay for the expenses.

One bonus to academic achievement is that the 10% penalty on 529 distributions is waived if the beneficiary gets a full scholarship.

Remember that money left in your 529 account after your child graduates can be used for another beneficiary. Money from a 529 account can be used for a lot of different educational programs like vocational and trade schools so you might still need the money later on if someone you know wants to brush up on their skills.

How will a 529 plan affect applications for financial aid?

Using a 529 plan will affect applications for financial aid but there is a way to still get the most aid possible.

529 plans owned by a dependent student or their parents count as assets on needs-based financial aid forms but only by a maximum of 5.64% of the plan assets. That means if you have $25,000 in your 529 account then it only reduces aid by $1,410 a year. That’s not too bad.

Educational savings plans owned by an independent student hit financial aid much harder, decreasing aid by 20% of the plan asset value. That same 529 account of $25,000 would decrease aid by five grand if owned by a financially independent student.

529 accounts owned by grandparents or someone unrelated to the beneficiary do not get counted against the student’s financial aid as assets. The problem is that any distributions to the student to pay for educational expenses are counted as income to the student for the next year’s financial aid.

What’s the smart strategy to get the most out of financial aid but still save in a 529 account?

- Have two accounts, one held by the parents and one held by grandparents.

- For the first few years of education expenses, pay out of the parents’ 529 accounts. This will reduce the amount of assets counted against the student for financial aid and the distributions are not counted as income for the student.

- For the last year of school, use money out of the grandparents’ 529 account. Money in this account doesn’t count as assets so doesn’t affect the student’s financial aid. Distributions to the student would be reported on their next year’s application for aid as income but that won’t happen if it’s their last year of school.

How is a 529 plan different from retirement accounts?

A 529 plan is only for paying educational expenses. That limits it a little compared to retirement accounts but it also doesn’t have some of the limits in 401Ks and IRAs. You can take money out of a 529 plan anytime you like as long as it’s for qualified expenses. You don’t have to wait until you’re retired.

529 plans also have a third-layer of tax advantage compared to retirement accounts, that ability to take money out tax-free.

Can I have a 529 plan and still invest in my retirement accounts?

Absolutely. A 529 plan isn’t a replacement for investing in a retirement account and you need both. While a 529 account has a lot of advantages, you won’t be able to use the money for retirement living expenses so you still need a 401K or an IRA.

Since your retirement living expenses will likely be much larger than planned educational expenses, you’ll be putting more money in your retirement accounts.

How much can I put in my 529 education plan each year?

Most 529 plans limit the amount that can be saved for each beneficiary but it’s usually a very high amount into the hundreds of thousands. That means that if a student is named as a beneficiary under parents’ and grandparents’ 529 accounts, both accounts are considered in the limit.

Most state plans also limit the tax savings you can take in any given year. For example, Iowa allows an income deduction up to $3,000 for each beneficiary on the account. So if you have two beneficiaries named in your 529 account, you could contribute up to $6,000 and take that amount off your Iowa taxable income.

You can always contribute more and there are no annual contribution limits for 529 accounts. You won’t get the immediate state tax deduction but you would still get the benefit of tax-free growth and tax-free withdrawals.

Federal law for gift taxes will apply but you can contribute up to $14,000 individually or $28,000 for a married couple per year to each beneficiary without paying gift taxes.

The best way to figure out how much to save in your 529 account is to look at how much you may need to pay for your child’s education.

According to the College Board, the average cost of tuition and fees for the 2016/2017 school year was $33,480 for private colleges and about $10,000 for in-state public colleges or $25,000 for out-of-state public colleges. Housing, meals and books added another $15,000 to that total.

Financial aid can reduce this amount considerably but might depend on how much the student or their parents earn. The average financial aid package ranged from $13,000 to $28,000 depending on needs-based tests of each family.

Put it all together and depending on where your child goes to school, you could need upwards of $20,000 or more for each year of college. You’ll need to save about $2,350 a year in your 529 account to grow it to $80,000 over 18 years at a 7% annual return.

How long do I have to spend the money in my 529 plan?

There’s no time limit on money in a 529 account. You don’t have to start using it by a certain age. You can change the beneficiary on the account and can use it for expenses for different people.

What happens if I don’t use my 529 money for qualified education expenses?

If any portion of the money from a 529 account isn’t used for qualified education expenses then you’ll face a 10% penalty and income taxes. Since you already paid federal taxes on the contribution, the penalty and income taxes only apply to the earnings on the withdrawal.

I’d think twice about withdrawing your 529 money for non-qualified expenses, even if you don’t think you’ll be able to use them. You can use the money at vocational and trade schools as well as community college so it’s really wide open where you can use it. The ability to change beneficiaries gives you even more flexibility.

What if my child is in high school, is it too late to open a 529 savings plan?

I’d say it’s never too late to start a 529 plan for your child’s education but there are some things you’ll want to consider.

Some state 529 plans work through a financial advisor that might be charging up to 5% in upfront fees. That’s really going to eat into your returns if the money is only building for a few years. Consider a lower-cost plan in another state if this is the case.

You’ll be paying for college for at least a few years so even if your child only has a couple years of high school left, you can still be saving for five or more years while they go to college. You’ll still get that triple-tax benefit on any money you put in and take out of the plan.

How do I set up a 529 savings plan?

The first step is to figure out which state’s plan you want to select for your 529 account. Finding state plans is easy with a Google search.

If your state offer’s an income deduction on 529 contributions then it’s an easy decision. A contribution of $3,000 could lower your income tax bill by $450 even on the 15% tax bracket. If your state doesn’t have an income tax or doesn’t offer a deduction then you’ll want to look at expenses charged by the plans.

I was fortunate that my home state of Iowa offers a deduction plus is one of the lowest-cost plans available. New York, Michigan and South Carolina also offer plans that are relatively inexpensive.

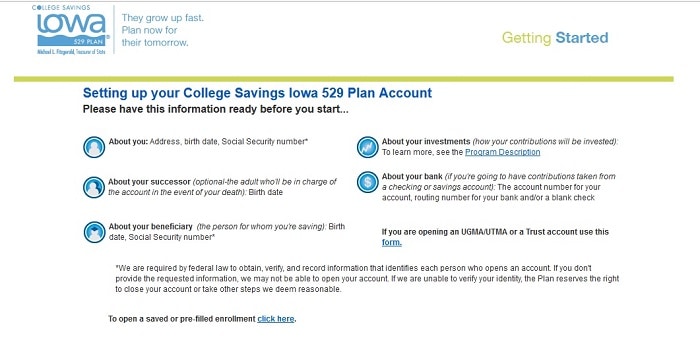

After deciding on a state’s plan, opening an account is easy and similar on most plans. You will need contact information for yourself and the plan’s beneficiary as well as social security numbers. Most plans allow you to link up your bank account to make regular or one-time contributions with automatic withdrawal.

Once you open your 529 account and put money in it, you’ll pick your investments from the list of funds available. Unlike 401K plans sponsored by your employer which often have multiple plan providers from which you can choose, state 529 plans usually only have one provider. You won’t have to worry about picking the best plan provider.

What investments should I make with in my 529 savings plan?

Many of the investment options in a 529 savings plan will mirror those available in a 401K account. Plans are managed by investment firms that offer mutual funds to savers and generally offer lots of choices.

As for the mix of investments you should choose for a 529 account, you’ll probably want much less risk compared to the investments held in your retirement accounts. It’s likely you’ll need to withdraw from the account within a decade or so, depending on the beneficiary’s age. That means your account might not have the time to bounce back from a stock market crash.

I would recommend a high percentage of the account in bond funds. You can get a little higher return in corporate bond funds but even these should probably highly-rated companies. You aren’t going to get the high rate of return on this account that you get from a long-term retirement account that’s mostly in stocks but your child’s education costs will be secure.

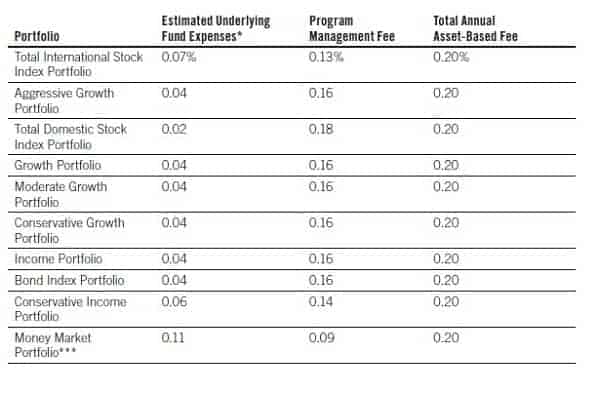

I’ve copied a screenshot of the available investment funds for the Iowa 529 plan as an example.

Not all state plans will offer fund choices all with the same total annual fee percentages but all in the Iowa plan cost 0.2% annually.

In the Iowa plan, you’ve got several funds that invest in stocks including the Total International and Total Domestic funds. The Growth and Income options invest in stocks and bonds with percentages in each asset class varying. The bond index portfolio is the only one that invests exclusively in bonds.

There is one type of investment usually available in 529 accounts that you might consider beyond this strategy.

The target date or age-based fund aligns investments and risk by the beneficiary’s age. If your child has more than a decade left to college, the fund would invest in riskier investments like stocks that might be able to provide higher returns. As the beneficiary gets closer to college-age, the investments are changed to less risky bonds for safety.

Who controls the investments in my 529 account?

Whoever opened and owns the account can control the investments and any withdrawals. Your state can change the plan provider, the investment firm that operates the funds, but almost all offer a nearly identical mix of funds. Plan providers are very rarely changed.

Can I change the investment options on my 529 plan after I already started?

You can, and should change the investments within your 529 plan. You won’t need to do it often, not even every year but maybe every five years.

You change the investments in the account because the beneficiary will need the money sooner. For example, you might start a 529 account when your child is born and has nearly two decades before college. For this account, you might invest heavily in stocks that have a better chance at higher returns. The account can bear the higher risk of stocks because it has 18 years to grow and plenty of time to rebound even after a stock market crash.

As your child ages, the time before they’ll need the money shortens. When they reach high school, it’s only a few years before needing the money and you can’t afford for stock market weakness to destroy their plans for education. By this time, you would want most of the money in the account to be invested in bond funds or very conservative investments. The annual return will be lower but the money will be safe and there when you need it.

Can I transfer my 529 plan investments to another type of retirement account?

You cannot transfer investments from a 529 plan to a different type of retirement account like an IRA or 401K. You can move the money but you’ll have to pay income taxes and the 10% penalty on earnings.

Again, the best thing to do with excess money in a 529 account is to let it set there earning tax-free returns. With the flexibility in naming beneficiaries and the uses, you might be able to use the money at some other point.

What happens to my 529 plan when I die?

Some state plans allow the owner of a 529 account to name a contingent owner. If you die, the account transfers automatically to the contingent owner. No taxes or penalties are due and the beneficiary remains the same. The only thing that changed is that someone else is now controlling the investments.

In other states, 529 plans may pass to the beneficiary if the original account owner dies. The beneficiary won’t have to pay taxes or a penalty but will just have a 529 account in their name and themselves as the beneficiary.

Some states have the 529 account pass to the owner’s estate and could be tied up in probate so it’s important to know the rules for your specific plan.

Tax Free Investments for Healthcare Expenses

Our final tax-advantaged saving account is the Health Savings Account (HSA). Healthcare costs are skyrocketing, increasing much faster than wages or other costs. Medical costs have been increasing about 6% a year versus wage growth under 2% annually. You don’t need to be an economist to see that it’s getting harder and harder to pay those medical bills.

The Bureau of Labor Statistics reports that the average household pays over $4,300 a year for healthcare. That’s out-of-pocket and including insurance, services and prescriptions and it amounts to more than 7% of income. Medical costs jump to $5,765 for people over the age of 65 and account for more than 13% of their income.

And healthcare is only getting more expensive but that’s where our last super savings account comes in.

What is a Health Savings Account (HSA)?

An HSA is a special savings account you set up specifically for paying medical expenses. It’s to healthcare costs what the 529 plan is to educational costs and they share a lot of the same advantages.

Money you put into your HSA is taken off your income before taxes. Many employers offer HSA accounts and will take the money out of your check before taxes. Even if you contribute to your HSA with money after taxes are taken out on your check, you can deduct that amount when you file each year to get the same tax savings.

Your HSA money grows tax-free while in your account and it’s tax-free when you take it out as long as it’s used for medical costs. It’s that same triple-tax savings that we saw with the 529 plan.

The only catch is that only people with a high deductible health plan (HDHP) are eligible to contribute to an HSA.

What is a High Deductible Health Plan?

A High-deductible Health Plan (HDHP) is exactly what it sounds like. It is health insurance with a deductible of at least $1,300 for individuals or $2,600 for families. These plans usually have much lower monthly premiums to pay but the amount you pay for medical expenses (the deductible) before insurance starts paying is higher.

The benefit to an HDHP is that you get those tax savings from your Health Savings Account plus you save on monthly insurance premiums.

Who is eligible for a HSA?

Anyone covered by an HDHP is eligible to contribute to an HSA. You cannot have other health insurance coverage including your spouse’s plan that is not high deductible. You are also not eligible once you enroll in Medicare.

Can a self-employed person contribute to a HSA?

Yes. Self-employed individuals can contribute to an HSA if they are covered by an HDHP. Self-employed individuals can also claim a deduction for insurance premiums they pay as long as they are not covered by another insurance policy.

Can I contribute to an HSA even if I have other insurance that pays medical expenses?

You can only contribute to an HSA account if your only health insurance coverage is through a high-deductible plan.

Am I eligible for a HSA if I am on Medicare?

No, Medicare recipients are not eligible to contribute to a HSA. You can continue to use money you previously put in your HSA after you go on Medicare.

How much can I put in my HSA?

The annual limit for HSA contributions is $3,350 for individuals or up to $6,750 for family accounts. The annual contribution limit increases each year.

Can I make catch-up contributions to an HSA if I am over 55 years old?

Yes. People older than 55 years and not enrolled in Medicare can contribute an additional $1,000 each year.

Can both spouses have an HSA?

Since spouses are usually covered under the same HDHP, it usually doesn’t make much sense to have separate HSA accounts. You can have separate HSA accounts but having just one allows you to combine the money to pay for each other’s medical expenses.

Can I make changes to my HSA contribution during the year?

Contributions to an employer HSA can be made throughout the year or early. Some employers will allow you to change your contributions but most only allow for a few weeks towards the end of the year to enroll and set your contribution schedule for the next year.

Do my HSA contributions have to be equal amounts each month?

You can contribute to your HSA in monthly payments or all at once. The custodian or plan provider might have minimum deposit or balance requirements.

What if my employer doesn’t offer an HSA, can I open one on my own?

You are eligible for an HSA if you have HDHP whether your employer offers an HSA or even if you are unemployed. Many banks offer HSA plans and will help you open one. The only benefit to using the HSA plan at work is that some employers will help contribute to the plan.

What is an Adult Child HSA?

With the ACA allowing people to stay on their parents’ insurance until the 26 years old, I’ve gotten a lot of questions about whether they can still have an HSA. This is where an Adult Child HSA comes in. There’s really no difference so I don’t know why it has another name.

As long as someone is covered by an HDHP, they can contribute to an HSA plan. That means your grown child can have their own HSA plan even if they are still covered under your HDHP policy. They don’t have to be the ones actually paying the premiums. The only stipulation is that they cannot be claimed as a dependent on your taxes, otherwise they would fall under your own HSA plan.

Does money in my HSA plan earn interest?

Yes. The money you contribute to an HSA plan will earn interest and most plans will allow you to invest in a selection of mutual funds to earn an even higher return. All earnings grow tax-free.

Understand that you may need money from your HSA plan at a moment’s notice to pay for emergency medical expenses. This means you probably don’t want too much of your account invested in risky assets like stocks.

How much you have invested in different asset classes depends on how much you have in your account and the maximum amount you might have to pay for medical expenses. If you have tens of thousands in the account and comprehensive insurance coverage, you can probably invest in riskier assets with some money set aside in safer bonds to cover any near-term medical expenses.

How do I set up an HSA account?

Most large banks or financial institutions offer HSA accounts to their customers. It took me less than ten minutes to fill out the online form for Bank of America including contact information and eligibility. You can make contributions directly from your bank account and most accounts will give you a debit card or checks to use the money.

Since you own your HSA account, you take it with you if you leave your employer even if the plan is set up through work.

How do I use my HSA money?

Most HSA accounts will come with a debit card or checks that you can use to pay for medical expenses. If your HSA doesn’t come with one of these, you pay medical expenses with your own money and then send the receipt to your plan provider for a refund.

Money in your HSA plan is available to use any time, even immediately after putting it in the account. You don’t have to wait to reach a certain age, you just need to pay qualified medical expenses.

You are responsible for keeping track of your contributions and withdrawals from your HSA account. Make sure you keep your receipts for anything you pay for with HSA money to use as proof in case of a tax audit.

What is a qualified medical expense for HSA money?

The list of qualified medical expenses that can be paid with HSA money is extremely inclusive and covers more than you would think. Besides the obvious doctor’s visits, prescription medicines and surgeries, you can also pay for things like eyeglasses, bandages, insurance premiums and acupuncture.

When in doubt, ask your doctor or healthcare provider if the service can be paid for with HSA money.

What happens if I don’t use my HSA money for a qualified expense?

Money in your HSA plan rolls over into the next year and has not time limit. You can keep the money in your account for as long as you like.

The tax bite for HSA money not used for qualified expenses is even worse than we saw in other spending and retirement accounts. Use your HSA money for something other than a qualified medical expense and you’ll have to pay income taxes on it plus a 20% penalty.

If you accidentally pay for something that isn’t covered as a qualified medical expense, you can always pay for something else (a qualified expense) and use the receipt from that for your HSA money.

What happens to my HSA if I die?

Your HSA money will do one of three things when you pass away, depending on if you’re married or name a beneficiary.

If you name your spouse as the beneficiary, they can just transfer the HSA into their account and use it like it was their own. They will pay no taxes on the transfer and can use it tax-free for medical expenses. This is the best option.

If you name someone other than your spouse as the beneficiary, your HSA money will transfer to them but will be taxed as income. They will be able to use the money for up to one year for any medical expenses you incurred before death but that’s the only exception.

If you name no beneficiary on your HSA account, the money goes into your estate. In this case, it will be taxed as income and may be subject to other estate taxes.

Can I pay my health insurance premiums with an HSA?

Yes. You can pay your health insurance premiums and any deductibles with money out of your health savings account.

Can I purchase long-term care with my HSA money?

Yes. You can pay for long-term care insurance with money from your HSA account.

If I drop my HDHP coverage, can I still use my HSA money?

You are not able to contribute more money to an HSA plan if you drop your HDHP coverage but you can continue to use the money already in your account. Once you pick coverage back up then you can start making contributions to your HSA again.

What happens to my HSA money when I retire?

Even though you can’t contribute to an HSA once you enroll in Medicare, the money is still yours. You can continue to use HSA money for medical expenses for as long as you have the account. Once you reach 65 years, you can use HSA money for any expenses without paying the 20% penalty though you will still need to pay income taxes on the amount.

How to Save on Taxes with Health Savings Accounts and 529 Plans

This section on tax free investments for education and healthcare expenses was about half the size as yesterday’s article on retirement savings plans but it’s still a lot to read. I didn’t say saving thousands a year in taxes would be easy but it is worth it.

Please, do not let these tax savings opportunities pass you by. It is hard enough saving and growing your nest egg. Don’t let the easy money slip away.

Even though the money you have in your 529 account and HSA will probably be invested in safe assets and not be making much of a return, it will still be some of the best investments you ever make. No Wall Street guru can get the double-digit returns you’ll get automatically just by saving on your taxes.

Read through this article on tax-advantaged savings accounts. Read through yesterday’s article on retirement investment accounts…and get the free money you deserve!

Getting the most in tax savings is easier than you think with online tax software. I reviewed the two most popular tax tools, TaxAct versus TurboTax, to see which offer the best price and features.

Eligibility for these last two tax free investment accounts is open to almost everyone.

- Anyone can contribute to a 529 plan.

- Anyone covered under an HDHP can contribute to a health savings account.

Contribution limits are a little more restrictive but you’ll still save hundreds a year on spending you’re going to have to make anyway. Healthcare expenses aren’t getting any cheaper and an investment in education is the best thing you can do for your children.

- You are not limited to how much you can contribute annually into a 529 plan but may have to pay gift taxes if it is over a certain amount per beneficiary. Beneficiaries are also limited to the total amount they can have available in a 529 account but it’s between $200,000 and $350,000 for most plans.

- The annual contribution limit for an HSA account is $3,350 for individuals or $6,750 for families (2017).

Talk to your employer to see when you can enroll in employer-sponsored accounts like the 401K or an HSA. Employees generally have to be working for six months before contributing to a 401K plan. Many employers designate a two- or three-week period towards the end of the year when you can enroll and make changes to your HSA plan.

Don’t miss these tax free investments and the best way to save on taxes with 529 plans and health savings accounts. These are the kind of tax savings that the wealthy pay advisors thousands a year to help them set up and save on taxes. You don’t need a high-priced advisor, just a little time and the drive to save money!

This article is originally on Finance Quick Fix.