Is Farmland A Good investment? How You Can Get Started

As you begin to build your wealth and diversify your investments, you might be leaving out one interesting option: farmland.

And no, you don’t actually have to be a farmer to invest in this real estate alternative! But why has farmland become a more interesting investment in recent years?

Well, according to Statista, the total farmland area in the United States in 2014 occupied a total area of approximately 913 million acres. By 2020, this amount decreased to about 896 million acres.

You might be thinking if the amount of farmland is decreasing, it must be a sign of a weak investment right?

Since the amount of available farmland is decreasing and there is very little correlation with other asset classes, this creates a high demand and proves to be a strong asset for your portfolio.

Ready to learn more and see why farmland can be a good investment? And how can you easily add farmland to your portfolio? These answers and more below. Let’s dive in!

Is Farmland A Good Investment?

So the main question you want the answer to: is farmland a good investment?

Farmland is a great option to add to any investment portfolio. Historically, farmland has generated strong returns for investors, helps hedge against inflation, and has low correlation to how traditional markets are moving. While the amount of available farmland continues to decline, the demand and need continues to increase.

Certainly, there are risks with investing in farmland as well, just like any asset class you choose. So it’s important to diversify your investments and ensure you aren’t risking all of your cash in one place.

But let’s explore why you should invest in farmland a bit deeper. Afterall, data and some analysis will show some of the past (and current) results.

Why Invest in Farmland?

Naturally, the main reason any investor chooses a particular asset class to invest in is to generate a decent return to expand their wealth.

Afterall, why invest if you don’t expect some kind of decent return?

According to Forbes, farmland represents a nearly $9 trillion market globally and has historically high returns. And for the past 47 years, U.S. farmland for example has yielded returns of over 10%!

And farmland has continued to demonstrate strong absolute returns over the past several decades. FarmTogether also points out that farmland has averaged 11% total annual returns (income + price appreciation) from 1992 to 2020.

With your farmland investment, you’ll typically generate a return from the increase in farmland value, from crop returns, rental payments of farmland to farmers, or a combination of ways.

However, there are a few additional reasons farmland can be a good investment to include in your portfolio too.

Diversification

As alluded to already, investing in farmland is a great way to diversify your investment portfolio. The more strategic you are about “how” and “what” you invest in, the better off you are during economic volatility.

Farmland has very little correlation to the stock market or even gold markets for example. Additionally, the volatility of farmland has historically been less aggressive compared to other assets as well, making it a more stable option.

Strong Demand

In the intro, you read that the amount of farmland has been decreasing. And what this does is only help create more demand and value for the land that is still available.

Plus, the world needs farmland to produce food for people and animals, alternative fuels, and other resources. The need for farming is not going anywhere and incentivizes you as the investor to take part in this asset.

Alternative To Real Estate

Yes, farmland is certainly a form of real estate. But maybe you are already investing in rentals or commercial buildings or the idea of being a landlord in the traditional sense is not for you.

Investing in farmland is a great way to still get into the “real estate” asset class, but in a different category with historically less volatility.

Additionally, the traditional real estate market is incredibly competitive and might not be something you want to deal with currently.

How Can I Invest in Farmland?

So farmland is sounding like a pretty interesting investment, right?

But now you may wonder how you actually get started with investing in farmland. Surprisingly, there are a few options to consider and one way that makes it easier than ever.

1. Buy farmland directly

Want to invest in farmland? Then you can go and buy a farm outright. However, investing in agriculture directly is very expensive and time-consuming.

If you have the necessary capital and interest, you can buy farmland directly which you then can rent out to farmers looking to grow crops and tend to livestock.

2. Investing in farmland debt

According to the USDA, farm debt is forecast to increase by $9.6 billion (2.2%) to $441.7 billion (in nominal terms), led by an expected 3.1% rise in real estate debt.

This gives you another way to invest in farmland, where you can buy farm debt and get consistent payments (with interest) when that debt is paid down by the farmers.

3. Farmland REITs & Equities

Another option is to invest in REITs or equities, which are publicly traded on the stock exchanges. It’s an easy way to get exposure to farming, farmland, and agriculture, but you aren’t really diversifying from the volatility of the stock market.

4. Crowdfunding with FarmTogether

The easiest way to invest in farmland today with fewer management hassles is through FarmTogether. This platform makes it easy to invest in various available farms around the United States or quickly source farms for sole ownership if you have the means.

In the next section, learn everything you need to know about the leading farm investment crowdfunding platform.

Invest In Farmland With FarmTogether

Thanks to investing regulations and new technologies, investing and diversifying your portfolio have become easier than ever before. And with FarmTogether, you can quickly scan their farmland offers for investments that make sense for you.

To date, FarmTogether is the best and easiest option to get started investing in farmland. Here’s more about how it works and what you can expect from the investment company.

How Does FarmTogether Work?

The process of investing with FarmTogether is pretty simple, but makes your life much easier than sourcing deals on your own and finding farmland.

The FarmTogether team only selects top-notch properties that they themselves will invest in. Utilizing their industry expertise and technology, they choose only the best properties to share with investors.

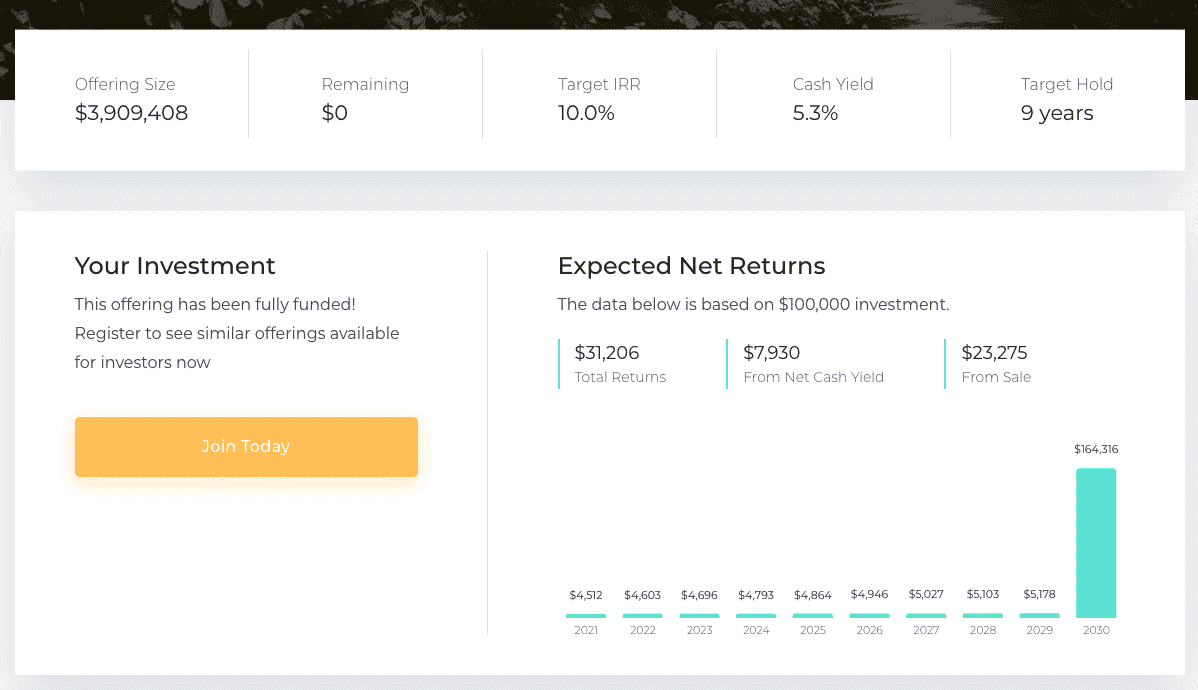

These farmland investments are then added to their “Offerings,” where an investor can learn about the property. Things like the offering size, target IRR, cash yield, target hold time frame, due diligence materials, market value drivers, operating agreements, and much more.

With any target investment opportunity, the FarmTogether team focuses on offerings that will return 7% – 13% and generally include 3% – 9% cash yields – all net of fees.

The farmland properties you can invest in will have a starting minimum investment of $15,000. This will be a much lower starting amount than you would typically need to invest if you source farms yourself and looked to purchase one.

Learn more about FarmTogether’s investing strategy and philosophy to dive in deeper.

What are the FarmTogether fees?

With the convenience factor and the ease of use for investors, FarmTogether does collect a fee for their services.

FarmTogether’s fee structure works out to be lower than the industry average and by utilizing their online self-serve platform, it helps keep your costs down. The fees will vary on every deal, but you’ll see what each investment opportunities’ fee is as they are listed with every offering.

Who can invest through FarmTogether?

Farmland is typically a larger investment and there is still risk involved as with any potential investment opportunity. With FarmTogether, you must be an accredited investor.

An accredited investor must follow the SEC’s definitions around this, which includes having an annual income of over $200,000 per year for the last two years, have a net worth greater than $1 million (individually or jointly) excluding the value of primary residence, and more.

You can read all about the SEC’s Accredited Investor guidelines to learn more and ensure you match the criteria. But recently in 2020, the SEC updated and modernized the definition — the first time since the 1980s!

FarmTogether wrote more about these changes and mentioned:

The new definition includes an alternative to the income and wealth tests: a knowledge test. Individuals who hold a current Series 7, Series 65, or Series 82 license are now also considered accredited investors. The SEC reasoned that passing these series exams requires knowledge of a broad range of financial concepts and a strong understanding of how capital markets work, making them a good test for financial sophistication.”

When will I receive returns from FarmTogether investments?

As an investor with FarmTogether, you will begin to receive returns with ongoing income payments and via price appreciation at the end of the hold period of your investment.

You can expect your income payouts to either be made quarterly, sem-annual, or on an annual basis pending the deal. And the money will be deposited right into your bank account.

This article is originally on Invested Wallet.