Rent Affordability Calculator | Find If You Can Afford Monthly Rent

According to a national rent report, rent prices are rising by about 1.4% nationwide. However, depending on where you live, rents are sometimes rising by even more of a percentage. They are even getting smaller in a few other places. If you’ve ever weighed your income against the cost of living in your area and questioned, “How much rent can I afford?” you’re like many other people. Your lifestyle and preferences, family needs, travel distances, and more all play a part in where you choose to live. The rent affordability calculator will greatly help you at this point.

Also, landlords must adhere to fundamental rent affordability rules when deciding whether to rent to a specific tenant. This is crucial to avoid renting to a tenant who will have difficulty making rent payments monthly.

Rent affordability may get determined in several different ways. This article describes these alternatives in-depth, along with the national trends in Rent Affordability Calculator use. Come along!

What is Rent Affordability Calculator?

The rent affordability calculator is a fast and simple tool that helps you determine how much rent you can pay depending on your salary. We advise considering the extra information offered in this article to understand better how affordable rent is in your specific scenario.

How does the Rent Affordability Calculator?

This calculator will assist you in figuring out what you can pay for a new property. You can use it through the following steps:

- Step 1: Put the total monthly income, including tax.

- Step 2: Enter total monthly expense (including groceries, utility bills, and fees)

- Step 3: Enter your Total Income Ratio % to spend on rents

Here is your result with Income after paying bills and Expenses

Rent Affordability Calculator

How is Affordable Rent Calculated?

The method used to determine affordable rent is as follows:

You may calculate the affordable rent by deducting reasonable utility expenses from the household’s monthly housing income.

How is Formula Rent calculated?

Split your yearly gross income by 40 to determine your rent. The 30 percent rule is another general guideline, which states that you may invest up to 30 percent of your yearly gross income on rent.

Renting Process

You could be a first-time renter, a young professional relocating closer to your place of employment, or even downgrading. There is a procedure that each renter must go through, regardless of the cause they are renting.

To make renting more accessible, we’ve laid out the procedure below for you in simple-to-follow stages.

Before Beginning

Before you begin your search, organize your finances and familiarize yourself with the expenses and allowable payments associated with renting.

Locate a Rental Residence

To make your search more fruitful, decide on your requirements for your rental home.

Create a Tenancy Plan

If you haven’t already, examine your money more closely. Examine what it regularly costs to maintain a rental.

Make rental arrangements

The application procedure gets described in terms of what you would need to sign and what kind of supporting material you may anticipate.

Tenant obligations

There are specific legal obligations that a tenant and a landowner have toward one another. Know what they are and what to anticipate.

Renew or terminate the lease

Do you want to prolong or terminate your lease early? Before doing so, get all the facts you need to know.

Leaving

Find out what you’ll do before leaving the property when your lease is up.

Keeping rental fraud at bay

Avoid falling prey to rental scams. For more on how to stop this from occurring to you, see our post.

Rent vs. Buy

If you’re like most individuals, you’ve undoubtedly found one or two dream homes when browsing listing websites. However, the decision to go from renting to owning must be made before finding your ideal house.

Before choosing what is suitable for you, there are several things to consider, including your money, lifestyle, and future ambitions. It’s much more difficult amid the currently booming property market. Join us as we compare renting vs. purchasing.

Renting’s Benefits and Drawbacks

The lack of engagement is the primary advantage of renting versus purchasing – you can move anytime you want, upkeep and renovations aren’t your concern, and a mortgage does not bind you. However, the other side is that you don’t own your home. You usually aren’t able to make any significant changes to your property, you can’t create home equity, and your monthly rent gets regulated by somebody else, subject to alteration at any moment. Renting is thus an excellent option for folks who aren’t quite ready to commit to a home for the long term.

Pros and Cons of Buying a Home

You have a share in something that is genuinely yours when you purchase a home and increase your home equity. This may be lucrative and a way to create riches that will last for many generations. However, it entails certain costs and obligations not everybody may desire or get prepared for.

You’ll be responsible for taking care of any repairs and upkeep and paying any fees on your home. Additionally, remain in your new home long enough to recuperate the initial expenses.

Further, in the present climate, purchasing a home requires negotiating the fiercely competitive housing market. This may be challenging, demanding, and time-consuming. However, homeownership may be a wise investment for years to come if you’re willing to commit and can pay the expenditures.

Rent vs. Buy: Tabular Representation

| Rent | Buy |

| Cheaper to move around regularly or go on trips | Less freedom to relocate or regularly travel |

| Building money with house rental is impossible. | With home equity, you may increase your wealth. |

| Not be required to pay housing authority dues, property taxes, or homeowner’s insurance. | Home costs such as upkeep, maintenance, property taxes, homeowners’ association dues, property insurance, and house insurance must be managed and paid for. |

| Typically, you cannot make significant changes to your home. | Freedom to make changes and renovate your home as you like. |

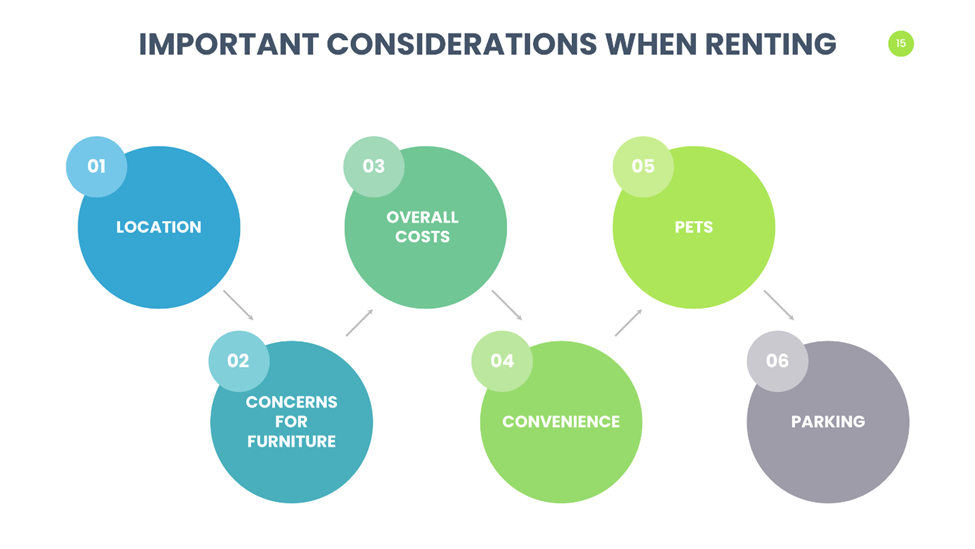

Important Considerations When Renting

Consider renting an apartment. You can convert a rental unit into a house only when you have a suitable space. It would help if you didn’t make emotional compromises while choosing an apartment or home to rent. Nothing compares to returning home to spend time with family, eat delicious cuisine, and unwind.

Only after you have located the ideal residence for you can you relax. You and your household are secure there. Given this, there are several things you should be aware of when renting an apartment. These consist of:

Location

Print out a neighborhood map before looking for an apartment, and mark the locations most significant to you with a dot. The site may be your workplace, a country club, Bridgewater Commons, or even the home of your favorite relative. Determine how far away from your preferred location you are willing to reside.

Draw a circle that includes the towns and areas within a 10-mile radius if you wish to live no more than that far away. Using the process, you may exclude undesirable areas and save time by avoiding apartment tours.

Overall Costs

When looking for a new house, you must consider your monthly expenses, not just the rent. Add the rent, monthly payment, pet, and storage fees to get the actual cost of an apartment. This comes from the application fee, typical utility and annual renter insurance costs.

Then divide by 12. Before you fall head over heels for a particular home, the figure you see will help to ensure there is enough space in your budget.

Convenience

When individuals think about apartments, convenience is an aspect that sometimes gets disregarded. Your flat could be lovely and roomy. However, your new home will quickly lose its appeal if it takes 20 minutes to go to the closest grocery shop or 40 minutes to get to the railway station.

When looking for an apartment, don’t hesitate to pick your commute into account. Measure the time it takes you to and from work by visiting the complex during morning and evening peak hours.

Concerns for Furniture

Are your furnishings going to fit in the apartment? If not, is purchasing new furniture within your price range? Measure your sofa, bed, dresser, and other significant furniture items before scheduling your next apartment visit. When you tour a rental complex, bring a tape measure to ensure your equipment will fit through doors and into rooms.

Pets

Even though your pet is a part of your family, not all rental communities agree. Before you even start your search, cross down the locations on your list that is unfriendly to pets if you own a dog or cat.

Bear in mind that many localities impose additional fees and restrictions on the kind, size, and several pets. The finest pet-friendly apartment buildings provide dog parks and other facilities with consideration for your four-legged buddy.

Parking

Parking a distance from your home has numerous advantages. Moving your items from the furthest corners of the parking lot will give you some exercise and fresh air. Find out whether the neighborhood has allocated parking places if a lengthy walk from your vehicle to your house doesn’t seem desirable.

If not, you should visit in the evening before signing a lease to see how many open spots are accessible for both tenants and guests. Do you dislike washing ice and snow off your car? Even renting out garages is possible in specific neighborhoods.

Ways to Reduce the Amount Spent on Rent

- Low savings may result from high rent.

- Choosing a Budget-Friendly Location

- Be adaptable to “Nice.”

- Locate a roommate.

- Select Your Rentals Wisely.

- Locating a Location.

- Learn the specifics.

- Recognize Any Potential Costs.

Practical Renting Pointers

Leasing property is a common way for companies to run their operations. Over time, the length and complexity of commercial leases have increased. The term “a standard lease” is also a misnomer. The following are some helpful hints you should consider if you’re preparing to rent out business space:

- Realistically evaluate your bargaining position, abilities, and limitations.

- Determine the “true” price per square foot.

- Agreeing on the Base Rent.

- Take into account HVAC replacement costs.

- Arrange the individual guarantee.

How Apartment Landlords Can Use Our Rent Calculator

This rent affordability calculator may be used by landlords looking for a means to confirm the income range that corresponds with the price of their unit listings. This might be a helpful first check on how much rent renters can pay before putting time and energy into the renter selection process. This handy tool may also help owners who are renting out their properties.

Frequently Asked Questions

How Much Rent Can I Afford?

Although there isn’t a one-size-fits-all solution, the consensus is to spend no upwards of 30% of your salary on rent. Your salary and way of living will determine how much rent you can pay. Take into account your monthly revenue as well as your numerous outgoings. For example, you may use the cost of food, petrol, student loans, or health costs to determine how much you can easily spend.

What does a rent check entail?

The affordability assessment, part of the reference check, confirms that your earnings will fully support the rent payments. Your gross combined yearly family income must be more significant than 30 times the median rental cost for you to pass the sustainability test.

Is the 30% rent rule realistic?

No. Experts say paying 30% of the rent in the long term can be a reckless move.

How much should my rent be if I make 60k?

According to experts, rent should not account for more than 25% to 30% of a renter’s gross pay. So, if you earn $60,000 a year, for instance, the total of your rent plus renter’s coverage shouldn’t exceed $18,000 or $500 every month.

But as with any generalization, your specific situation may cause your optimum rental budget to be larger or lower.

How standard rent is calculated

Split your yearly gross revenue by 40 to determine. The 30 percent rule is another general guideline, which states that you may expend up to 30 percent of your gross annual income on rent.

How much rent can I afford on 30k UK?

If your income is £30,000 after taxes and benefits, you should pay yourself £875 monthly rent.

How do you fail a credit check for renting?

Because their income is regarded as insufficient for them to cover the rent adequately, tenants frequently fail credit checks. Agencies anticipate their gross salary will be at least twice as much as the rent. They will instantly reject anybody making less money since this requirement might be as high as three times the rent.

How much of my salary should I set aside for rent?

The 30% rule is a standard to adhere to while planning for rent. Rent in this location is limited to 30 percent of your total monthly income (before taxes).

What is the 50 20 30 budget rule?

The 50/30/20 rule is a simple budgeting technique that may assist you in managing your money efficiently, straightforwardly, and sustainably. According to the general rule of thumb, you should allocate 50% of your annual after-tax income for necessities, 30% for desires, and 20% for investments or debt repayment.

How much house can I afford, making $70000 a year?

Therefore, if your annual income is $70,000, you must be likely to afford a minimum of $1,692 and a maximum of $2,391 every month. Ideally, this would take the shape of rent or mortgage repayments.

How do I figure out what 30% of my income is?

Split your yearly gross revenue by 40 to determine. The 30 percent rule is another general guideline, which states that you may invest up to 30 percent of your gross annual income on rent.

Is spending 30% on rent too much?

The 30% rule is a standard while budgeting for rent. Rent in this location is limited to 30 percent of your monthly earnings (excluding taxes).

What percentage of income should get spent on rent?

Thirty percent of gross revenue should get allocated for rent.

What is considered house poor?

An individual who invests a significant percentage of their salary on homeownership, such as loan repayments, property taxes, servicing costs, and utilities, is called “house poor.”

How much money should you have left after bills?

Although this idea may differ from individual to individual, as a general rule of thumb, allocate 50% of your income to spend, 30% to debt repayment, and 20% to savings.

How much should I spend on a house if I make $100 K

A basic rule of thumb is to multiply your salary by at least 2.5 or 3 to obtain an idea of the highest house price you can afford when calculating how much credit you can pay. The highest price you could buy with $100,000 in annual income is nearly $300,000.

How much of your net income should you spend on housing?

According to the 30 percent rule of thumb, you shouldn’t pay over one-third of your annual wage in rent every month. The 30 percent rule often gets used as a benchmark for rental house prices because of national housing policies.

What percentage of income should go to rent Ramsey Dave

No more than 25% of your gross income should be used to cover your rental.

References

- https://www.moneysense.ca/spend/real-estate/renting/can-young-people-afford-to-live-in-the-city/

- https://www.quickenloans.com/learn/how-much-house-can-i-afford

- https://www.gurufocus.com/news/1792142/rent-is-at-an-alltime-high-but-renters-still-have-opportunities-to-save

- https://mauinow.com/2022/07/01/despite-pushback-new-affordable-sales-price-guides-for-maui-county-advance/

- https://www.nytimes.com/2022/06/22/nyregion/rent-regulation-new-york.html

- https://www.nytimes.com/2022/06/23/realestate/owning-renting-disparity.html

- https://rentprep.com/collecting-rent/how-to-calculate-rental-rate/

- https://www.triplecrowncorp.com/how-to-calculate-an-affordable-rent-payment/