VA Mortgage Calculator | Estimate Your Monthly Mortgage Payments

A certified Certificate of Eligibility is required for VA mortgages, a government-backed mortgage scheme specifically for veterans, active-duty service members, and certain military spouses (COE). VA loans’ many advantages are their $0 down payment requirement, absence of private mortgage insurance (PMI), and often cheaper interest rates. Utilizing the VA mortgage calculator is advisable if you’re unsure whether you match the qualifying standards for the VA or are ready for a customized estimate. The following highlights this as a result.

The U.S. Department of Veterans Affairs also guarantees the VA loan and a mortgage. A private lender, such as a bank, credit union, or mortgage firm, issues the loan. Because a VA loan normally doesn’t need a down payment, it might be simpler to purchase a property. The VA mortgage calculator can help you calculate this without hassles. Come along as we highlight this below.

What is the VA mortgage calculator?

The VA mortgage calculator is a great tool for quickly calculating your VA loan.

Depending on the statistics you provide, this VA loan calculator generates information that is specifically tailored to you. However, it may make a few assumptions about you. For instance, your principal dwelling will be a single-family house. Additionally, this calculator includes substantial assumptions regarding closing costs, lender charges, and other expenses. The VA mortgage calculator can provide adequate guidance before applying for a loan.

How to Use the VA Loan Calculator

The majority of VA Loan Calculators may be used in the steps listed below:

- Add your VA loan amount

- Put the interest rate per annum

- Enter the number of months

VA Mortgage Calculator

What is a VA loan?

A VA loan is an aid usually granted by the U.S. Department of Veterans Affairs. They also guarantee mortgages for veterans, active-duty military personnel, national guard members, reservists, or surviving spouses (VA). Anyone who received a DD 214, which attests to an honorable release on good terms, may be eligible. VA loans aim to assist the nation’s increasing numbers of homeless veterans in finding decent housing. Due to the particular population that qualifies, VA loans only account for a tiny fraction of all mortgages in the U.S. However, studies show they have the least foreclosure percentages of any loan type.

The VA loan program also provides a range of possibilities. This covers mortgages for new purchases and refinances, loans for repairs and improvements and the Native American Direct Loan. Here is a summary:

| VA loan program | Features |

| A mortgage insured by the VA | Enables qualifying military members to purchase a house with no down payment. |

| Refinancing with VA cash out | An option to convert home equity to cash; Substitutes a VA or conventional mortgage with a VA loan. |

| VA streamline refinancing | Refinances from an adjustable to a fixed rate or replaces an existing VA mortgage with a VA loan to reduce interest rates. |

| VA loan for rehabilitation and repair | Provides funding for home remodeling expenses. |

| Native American Direct Loan | Aids qualified Native American veterans in the purchase, construction, renovation, or refinancing of a residence on federal trust property. |

What is the VA Funding Fee?

The VA mortgage calculator takes your VA financing fee into account automatically. A proportion of the loan amount is used as the charge. Additionally, it varies based on your down payment size and if this is your first VA loan. If you have previously used a VA loan, the following loan is regarded as “subsequent usage.”

The table below makes it simple to determine the costs associated with a first-time VA purchase loan:

| Down payment | Funding charge for the first usage | Funding charge for later use |

| 0 per cent to 4.9 per cent 5 per cent to 9.9 per cent | 2.3 percent. 16.5 percent. | 3.6 per cent. 16.5 per cent. |

| 10 per cent or more | 1.4 percent. | 1.4 percent |

Who is eligible for a VA loan?

Because there is no down payment necessary, VA loans are appealing to individuals who qualify. Compared to many other mortgage loan kinds that you may get with comparable conditions, they also offer cheaper interest rates. There isn’t any ongoing mortgage insurance for them.

Lenders are free to establish their standards for certain parts of qualification. But compared to many other mortgage programs, VA loans have more flexible credit standards.

Not every veteran of the armed forces is eligible for a VA loan. To be eligible, you must fulfill at least one of the requirements listed below:

- During peacetime, you were on active duty for 181 days.

- You’ve completed 90 days in a row of active duty during a war.

- You have at least 90 days under Title 32 service, with at least 30 continuous days, or you have served in the National Guard or Reserves for more than six years.

- You are the surviving spouse of a serviceman who died in the line of duty or suffered a disability related to their service. The rule is that you cannot remarry. However, there are several exceptions.

- You served for 90 days on active duty or six years in the Selective Reserve or National Guard, whichever came first.

- In rare circumstances, you may still be eligible even if you don’t fulfill the length-of-service standards. This includes being fired for having a handicap related to your service.

If you were discharged for “other than exemplary,” “poor conduct,” or “dishonorable” reasons, you might not be qualified. However, you may request an improvement in your release status via the VA.

Frequently Asked Questions

How Do the Interest Rates for VA Home Loans Compare With Those for Other Mortgage Products?

Your financial standing as a lender may be more important than the loan you seek regarding interest rates for traditional financing and VA loans. VA loans may be somewhat less expensive. However, this relies on the lender and your credit history. The following table shows a comparison:

| VA loans | Other Mortgage Products |

| The top mortgage product rates are comparable with VA loan interest rates. In actuality, they’re a little higher on average. | Mortgage Product rates are similar to VA mortgage rates for applicants with good credit scores of 720 or above. |

| The typical 30-year rate for a VA loan in 2022 is 3.02 percent. | In 2022, the average 30-year rate on a Mortgage Product is 3.26%. |

When Is the Best Time to Get A VA Home Loan?

There is no ideal moment to get a VA mortgage. Starting the procedure early is perfect. This is true since obtaining a VA loan might take longer than normal. This happens due to the appraisal and certification process’s added paperwork needs. However, lenders will get more advantageous conditions, which may result in cost savings of thousands of dollars throughout the loan.

Before completing a sales contract, borrowers may take specific actions to speed up the process, such as obtaining a Certificate of Eligibility. This also requires you to have the additional paperwork needed for the underwriting procedure.

What is the monthly payment for a VA loan?

The available options will determine the VA loan’s monthly cost. You can use our VA mortgage calculator to estimate your monthly payment.

Do VA loans require monthly mortgage insurance?

No. On a home mortgage that is VA-backed or VA direct, the Veteran, service member, or survivor makes a single payment known as the VA funding fee. Given that the VA home loan scheme does not call for down payments or ongoing mortgage insurance, this charge aids in reducing the cost of the loan for American taxpayers.

Do VA loans include taxes and insurance?

Yes. It’s simple to believe that your monthly mortgage payment is a certain amount. However, payments for VA mortgages are divided into four categories: principal, interest, taxation, and insurance (PITI).

What is the average mortgage insurance requirement on a VA loan?

There is no need for private mortgage insurance for VA loans. However, a VA financing fee, which is a portion of the overall loan amount, must be paid at closing. The money from that charge keeps the program functioning for future borrowers.

Can closing costs be included in the VA loan?

Yes. A VA loan may include some closing fees into your overall loan amount. The important part is that your financing charge may get rolled into the final mortgage amount. Even though the interest costs may be higher, this might let you buy a house right away.

Do VA loans have higher monthly payments?

No. If you make a down payment on a VA loan, you’ll have a reduced loan. As a result, your monthly repayments and overall loan interest costs will be cheaper.

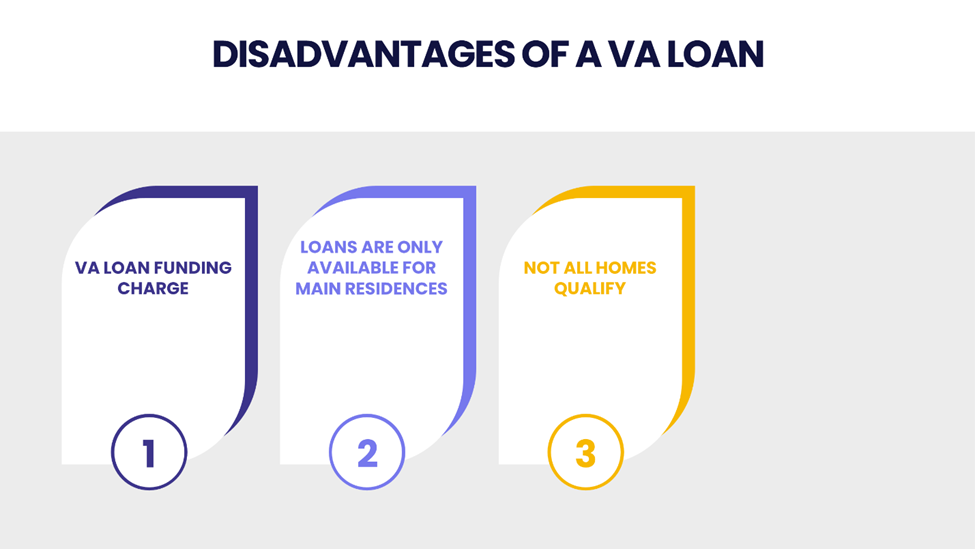

What are the disadvantages of a VA loan?

For certain borrowers, there are disadvantages to every loan form. The following are some drawbacks of a VA loan:

- VA loan funding charge: Even though VA loans are exempt from mortgage interest, they have an additional fee known as a funding fee. The cost of foreclosure in the event of a borrower failure is covered by the charge, which the federal government establishes. Based on your deposit and if this is your first VA loan, the charge varies from 1.4 percent to 3.6 percent of the loan. The charge may be paid up in advance or added to the loan.

- Loans are only available for main residences: A VA loan cannot be used to purchase an appreciating asset or a second house.

- Not all homes qualify: The house you intend to purchase will be assessed by an appraiser authorized by the VA. You may use this to determine the value and confirm that it satisfies the VA’s minimal property standards. All fixer-uppers may not meet the VA’s basic requirements.

This has also been highlighted in the infographics below.

What is the VA funding fee for 2022?

For first-time homebuyers with no down payment, the VA financing fee for 2022 is 2.3 percent of the loan amount.

How much are closing costs in VA?

Closing expenses for VA loans generally range from 1 to 5 percent of the loan amount. The VA financing charge, which may range from 0.5 percent to 3.6 percent of the loan amount, is one of the factors contributing to the wide variations in VA closing expenses. This also depends on the kind of loan you have.

How do I avoid the VA funding fee?

You are excluded from the funding fee in 2022 if you are:

- Are eligible for or receive benefits for a disability related to their service.

- The living spouse of a veteran who passed away while serving or due to a disability resulting from their service.

- A Purple Heart recipient who is currently on active duty.

Do you pay taxes on a VA home loan?

Yes. You most likely paid a VA financing fee when applying for your VA loan. The value of the loan for American taxpayers has decreased thanks to this charge. Most of the time, VA lenders are qualified to deduct the full charge from their taxes.

How can I avoid closing costs with a VA loan?

Several strategies to lower your VA closing expenses include: 1. Depositing to reduce the VA funding charge.

- Applying to do so if you’re eligible.

- Striking a deal where the seller covers most of the closing fees.

- Buying discount points to lower your loan’s interest rate.

How much is the VA funding fee?

The Department of Veterans Affairs will receive the VA funding fee as a one-time payment. This charge varies from 0.5 percent to 3.6 percent, with the average Veteran paying 2.3 percent. This depends on whether you’ve used a VA loan previously and if you have more than a 5% deposit.

Do VA loans require a down payment?

No. There is no down payment necessary with VA loans. You might need to reimburse the VA funding fee alternatively. The loan expense for American taxpayers has been reduced thanks to this one-time charge. This is true since VA home loans have no down deposits or mortgage insurance payments. In addition to closing costs, your lender will typically charge interest on the loan.

Will the VA pay my mortgage?

Only the Partial Claim Payment Program allows the VA to pay your mortgage. The VA will then arrange a second mortgage on the property and make any past-due mortgage repayment. The second loan has no interest. Additionally, no payments are required until the member sells the house or settles the initial mortgage.

EXPERT ADVICE

The VA home loan program’s main goal is to provide qualified veterans with housing finance and assist them in making zero-down purchases of real estate. Lenders that meet the requirements may provide the loan. Additionally, the VA does not originate loans; it establishes eligibility criteria, specifies minimal standards and requirements for mortgage offers, and provides financial warranties for loans that meet program requirements.

And for those who need help with the calculations, the VA mortgage calculator will aid you immensely.

References

- https://www.nationalvaloans.com/va-loan/va-loan-eligibility/

- https://capitalbankmd.com/homeloans/resources/home-loans-101-blog/va/a-complete-overview-of-va-loans-guidelines

- https://www.va.gov/housing-assistance/home-loans/eligibility/

- https://www.veteransunited.com/va-loans/va-home-loan-eligibility/

- https://www.cnet.com/personal-finance/loans/eligible-for-public-service-loan-forgiveness-you-have-a-new-student-loan-servicer/