Do you Pay Property Taxes on an Apartment

Are you here to determine whether you pay property taxes on an apartment? This article will help you understand the information on property taxes paid for your apartment. This article includes how you can pay the taxes, whether it is your local supplier or if it is part of your mortgage plan. This guide has it all.

The answer is both Yes or No. The homeowner pays property taxes, but certain landlords include this expense in their tenants’ monthly rental amounts. Some may charge a little more to cover building and property expenses while making a profit.

The American government has been collecting and taxing property since the 1780s through estate taxes. However, with the rise in commercial real estate investment activity and sales, some people worry that these transactions are not subject to state or local income tax, so they can take advantage of this exemption.

That’s why many Americans marry and have children and don’t have to pay state or local property income taxes. To avoid paying real estate property taxes, you may want to review the following:

Are you going into foreclosure? Are you thinking about selling the house? How does the sale process work if the buyer doesn’t pay any money? Don’t buy an apartment until you know all the answers to these questions. If you own an apartment, it’s likely time to make repairs. It could be worth more than you thought. Have a list so it can be sold at a later date.

What is a Property Tax?

A property tax, usually a millage rate, is levied by most state government ministries in the United States as their main income source. Either real estate or personal assets may be subject to this tax. The tax is typically owed by the property owner and is calculated as follows: fair market value of the property multiplied by an assessment ratio and then a tax rate.

Local government authorities set values that landowners can contest.

When do you Pay Property Taxes?

Property or Estate tax payment terms and procedures might be very different. The time of the tax payment varies widely. Many localities require a payment, which is single, of real estate taxes by January 1st. multiple installment payments are permitted in many jurisdictions.

The first installment payment is based on tax from the preceding year in some areas. Cash or checks given in person or mailed to the taxing jurisdiction are usually accepted forms of payment.

Who has to Pay Property Taxes?

Most estate owners are legally required in every U.S. state to pay property taxes, and state property taxes differ. If you’re thinking about looking for a home, you should evaluate the property taxes in the area because they increase the expenses of your homeownership.

The primary tax advantage for homeowners is the lack of taxation on the imputed rental income they generate. Although such revenue is not taxed, homeowners could still offset mortgage interest and estate tax payments, as well as certain other costs from their federal taxable income, if they itemized their deductions.

Property (Apartment) Tax of the USA in 2022

- Hawaii – 0.28%

- Alabama – 0.41%

- Colorado – 0.51%

- Louisiana – 0.55%

- South Carolina – 0.57%

- Delaware – 0.57%

- West Virginia – 0.58%

- Nevada – 0.60%

- Wyoming – 0.61%

- Arkansas – 0.62%

- Utah – 0.63%

- Arizona – 0.66%

- Idaho – 0.69%

- Tennessee – 0.71%

- California – 0.76%

- New Mexico – 0.80%

- Mississippi – .81%

- Virginia – 0.82%

- Montana – 0.84%

- North Carolina – 0.84%

- Indiana – 0.85%

- Kentucky – 0.86%

- Florida – 0.89%

- Oklahoma – 0.90%

- Georgia – 0.92%

- Missouri – 0.97%

- Oregon – 0.97%

- North Dakota – 0.98%

- Washington – 0.98%

- Maryland – 1.09%

- Minnesota – 1.12%

- Alaska – 1.19%

- Massachusetts – 1.23%

- South Dakota – 1.31%

- Maine – 1.36%

- Kansas – 1.41%

- Michigan – 1.54%

- Ohio – 1.56%

- Iowa – 1.57%

- Pennsylvania – 1.58%

- Rhode Island – 1.63%

- New York – 1.72%

- Nebraska – 1.73%

- Texas – 1.80%

- Wisconsin – 1.85%

- Vermont – 1.90%

- Connecticut – 2.14%

- New Hampshire – 2.18%

- Illinois – 2.27%

- New Jersey – 2.49%

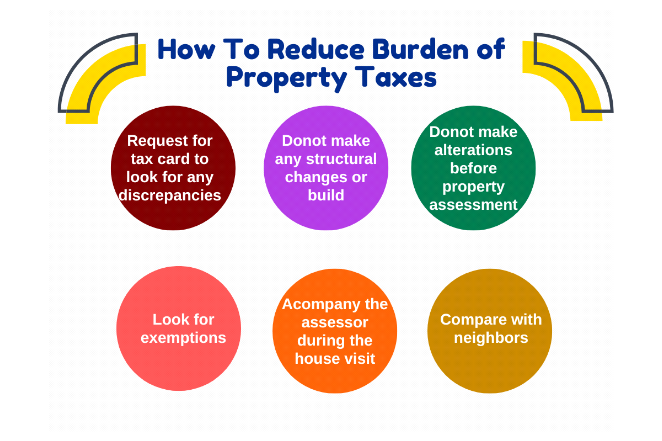

Strategies to Reduce the Burden of Property Taxes

How Much Does Property Tax Cost?

According to Wallet Hub and Census Bureau statistics, the typical American spends $2,471 in real estate taxes annually. The median property tax in New Jersey is $8,300 annually, whereas it is $587 in Alabama. Depending on the state’s rate of taxation and typical house prices, these taxes range substantially.

Taxation is assessed depending on the quality and value of the property, and the average rate is now between 0.1% and 1.9%.

Some states have affordable housing, low taxation on the property (less than 0.5%), and low annual property tax payments (a few hundred dollars on average). However, one of the most costly states has a rate that rises beyond 2%, expensive properties, and average yearly property tax expenditures often exceed $5,000.

These taxes are expensive because we frequently place a high value on our neighborhood. Property taxes, however, pay for municipal amenities like infrastructure and educational institutes.

How to Pay Property Taxes?

Property taxes are a cost of homeownership. This is how. The governments collect taxes to help pay for the initiative and programs that would help the community.

This will also include the infrastructure, emergency services of the community, education and law enforcement. Now, how are you going to pay the taxes? There are two main ways you can pay property taxes.

- The first one is that you pay directly to your local tax office

- The second one is that you pay the tax as a part of your monthly mortgage payment.

Paying taxes to your local office;

If someone is not paying taxes as a part of their mortgage plan, they have to pay directly to their local office.

Your invoice should come with a fund transfer in your own mail. There is a variety of paying alternatives available depending on where you live:

- Through the mail with a check or money order

- Through the mail with a check or money order Through credit and debit card

- With an electronic cheque (E-Cheque) if the payments are online

- Credit or debit card over the phone

Along with the various payment choices, you can decide whether to pay the amount in one lump sum or over a year or two. Pay notice to any prepayment discounts provided; in certain localities, paying early might result in a reduction.

As a part of the Mortgage plan

If someone is not paying taxes directly to the local office, he can pay the property tax as a part of his mortgage plan.

What he has to do; He has to pay a specific amount of tax every month with a mortgage of his property to pay off the taxes on time. This payment method is simple to understand for a human brain.

Exceptions to Paying Property Taxes on an Apartment

There are few exceptions for people to pay taxes that meet certain criteria. These exemptions include;

- Government buildings

- Religious buildings

- Non-profit buildings

Other exemptions are also possible for the country’s senior citizens, veterans, and most importantly, the START, who are the school Tax relief program participants.

The USA has 50 states and 3,142 counties or districts or municipalities that are equal to counties. There are around 3,142 different methods for calculating taxes of properties since they are normally evaluated and received at the county level by state regulations. Additionally, you can be eligible for a few local exceptions.

Property taxes, however, are often Valorem taxes. This is a sophisticated way of expressing that they are taxes expressed as a percentage of the item’s average net worth. The municipalities determine a property’s worth through an assessment and then impose a tax based on that value.

Important; for the exemption, you have to fill out a form.

Frequently Asked Questions

What do property taxes pay for?

The governing body of the local community will collect the tax, and then they will utilize these taxes for the following things.

- pay for the water

- upgrade the sewer

- Do upgrades for the other community-beneficial services, including law enforcement, Libraries, education, and road and highway construction.

Can I stop paying property taxes?

No, you cannot stop paying property taxes; otherwise, you will have to face legal action by the government authorities.

- Your house or the asset secured by the taxing authority’s lien might be sold to pay off your obligation.

- Alternatively, your mortgage lender could settle the taxes and charge you.

- The mortgage lender has the right to seize your home if you don’t pay it back.

Is there any way to lower your property tax bill?

Yes, there is a way to lower your property, but there is also a chance of a rise in your taxes.

Your property tax bill will rise if the examiner determines your property is worth more. However, a few methods exist to reduce them, such as requesting exclusions and making tax appeals.

Expert Opinion

Property taxes are crucial, in my opinion, since they serve your interests in the best possible way. The government uses the taxes you pay for your well-being. The government uses these taxes to pay for water, police, libraries, sewers, roads, and educational institutions. Therefore, if you pay taxes, remember that you are doing so for your advantage and the good of the community.

For some people, the taxes are consumed by a few people.

Less than you’d get unless you are impoverished or an illegal immigrant.

The sole consumers of the current tax system are those who receive assistance or welfare benefits and social security. The individuals on welfare must seek employment, but they don’t because our system incentivizes them to do so. Because of this, those of us who pay taxes are upset and not happy and want to get rid of these taxes, so we use different methods to avoid taxes.

References

- https://en.wikipedia.org/wiki/Property_tax_in_the_United_States

- https://www.businessinsider.com/personal-finance/average-property-taxes-every-us-state

- https://www.investopedia.com/articles/pf/07/property_tax_tips.asp

- https://belonghome.com/blog/property-taxes-by-state

- https://learn.roofstock.com/blog/property-tax-by-state

- https://www.rocketmortgage.com/learn/property-taxes-by-state

- https://taxfoundation.org/property-taxes-by-state-county-2022/

- https://www.cnet.com/personal-finance/taxes/illinois-tax-rebate-2022-find-out-if-you-qualify-for-a-check/

- https://www.nbcchicago.com/news/local/who-is-eligible-for-2022-illinois-tax-rebates-what-to-know-as-checks-begin/2937419/