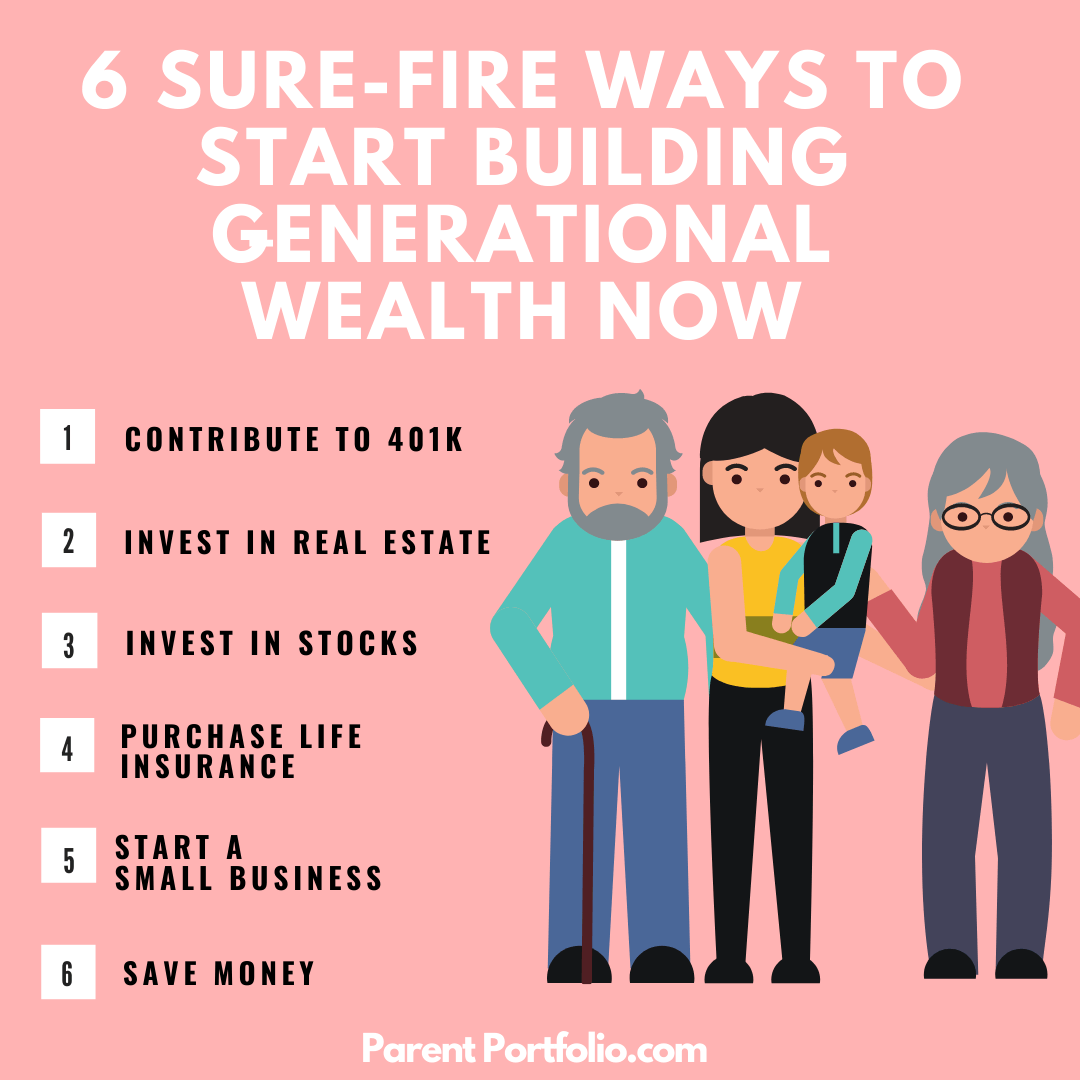

6 Sure-Fire Ways to Start Building Generational Wealth Now

My husband and I started building generational wealth after discussing the enormous amount of student loan debt in our country, especially young adults. I, too, was part of the statistic with over $250,000 in student loan debt. Fortunately, I was able to get rid of all that debt.

After that discussion, we wondered about our children. We didn’t want that kind of financial hardship on our two kids.

Instead, we wanted to build something that could teach our kids to be fiscally responsible and be something we pass down to them and future generations!

What is the Meaning of Generational Wealth?

Generational wealth is assets that parents pass down to their children and, ideally, their children’s children. Wealth is not necessarily money. Instead, I define wealth as time bought with your money or assets.

For example, a person has an amount of three months worth of expenses in a savings account. This person can live for three months without working before running out of cash. For this reason, the wealthy acquire assets that generate passive income, which allows them to gain more time!

Passing down income-generating assets to their children are the ways families have been able to remain financially stable.

Why Is Generational Wealth Important

You might be wondering, “Why should I care about generational wealth?” or “Generational wealth just creates trust fund babies that don’t know how to work a day in their life.”

I hear what you’re saying, and I can understand many people feel about those who were born with a “silver spoon in their mouth.”

I grew up in an unprivileged family and lived in a small one-bedroom apartment. Also, I worked hard in school and currently make a decent salary with my career.

Some would say that is a blueprint of success: focus and hard work guarantees returns. However, that hard work came along with heavy student loan debt and a high-stress job.

I’m not saying I’m not grateful because my job has helped fund a couple of family business ventures. I am saying that I can pass down wealth to my children that they can use to give them more opportunities!

Generational wealth can give our children the ability to attend school without student loan debt. Or, they can inherit a family business and become entrepreneurs.

The options can become endless for your family members. The key thing I want to point out is that they have options!

How Much Money is Generational Wealth?

There isn’t a magic number or exact net worth that a person can attain to say they can provide generational wealth.

In general, when people ask, “How much is enough?” the answer is relative to your specific situation. So, don’t be bogged by a particular dollar amount.

Instead, ask yourself, “Is there anything I can pass down to my children to make impactful changes to my family tree?”

How to Build Generational Wealth

Do you wonder where millionaires or the wealthy keep their money? There is no secret to building long-term financial success. If anything, it’s boring.

They do not hide their wealth in rare paintings or fancy yachts. Instead, these assets are accessible to everyone allowing them to create generational wealth!

Contribute to 401k

Most companies provide 401k plans, which offer major tax advantages. It allows their employees to contribute pre-tax dollars from their paycheck to a retirement plan and reduce their taxable income.

Additionally, many employers offer to also match your contribution up to a certain percentage. This extra contribution is technically free money.

With the help of compounded interest, your contribution can grow to be a healthy nest egg. Another option is to contribute to a Roth 401k, which allows an employee to contribute post-tax dollars from their paycheck. This type of retirement account helps people avoid a high tax bill when they retire.

My husband and I both have 401k plans with our company, and we use to contribute 10% of our paycheck. We’ve adjusted our contribution to only contribute to the employer’s maximum match and redirected the difference in other investment opportunities.

Invest in Real Estate

Real estate investing is an incredible income-producing asset that can make money and add to your overall net worth. The great thing about real estate investing is that the tenants are the ones paying down the debt service while you reap the benefits of monthly cash flow and appreciation.

You can have the properties on shorter mortgage terms, such as 10-year or 15-year terms, to have the tenants pay off the loan sooner. A shorter term will drastically increase your cash flow after the loan is gone.

Additionally, the market value of the property will appreciate over time. You don’t necessarily need a real estate empire to reach a million dollars!

We own a couple of investment properties in our local real estate market. In our first year and a half of investing, we acquired a new investment property every six months! You convert your first home into a rental property if you ever decide to move.

Good news! We’ve developed a course to share with you how we acquired three investment properties in our first 18 months, grossing over $4,000 a month.

SIGN UP NOW AND SAVE AN EXTRA 30 TODAY%!

Invest in Stocks

Stock market investments, such as index funds, are another form of creating generational wealth and are more liquid than real estate. The stock market also might be a better option than real estate if you’re not a fan of managing tenants. Initially, for our retirement planning, we started invested in mutual funds before we decided to diversify our portfolio.

Just like the 401k, the help of compounded interest and reinvesting the dividends can help grow your money over time. Your investment strategy will also change over time, depending on how far you are away from retirement.

Purchase Life Insurance

It’s always important to prepare for the worse, especially for your untimely death. Therefore, buying a life insurance policy is necessary to protect your family from financial hardship!

A life insurance company will pay your beneficiaries as part of the death benefit for a relatively low monthly premium. Hence, consider reaching out to a professional insurance agent to provide you different life insurance policies to choose from. Or, speak with a financial advisor whose financial services include life insurance policies.

Start a Small Business

Although not commonly discussed in financial planning, small businesses are an excellent way for building generational wealth for their loved ones.

After my husband and I discussed our concern about children’s financial future, he shared with me a few days later and suggested we start our own small business. The goal was not just to teach them about money but also to show them how to manage money with hands-on experience.

We frequently include our children in our business discussions and can see the positive impact it has made. My son doesn’t ask for the latest toy. Instead, he asks what kind of successful family business he should start.

The goal is to hand over the small business to my children ultimately!

Save Money

Another simple way toward building generational wealth is by saving. Although it may be a simple concept, not everyone does it. It’s become the norm for people to have a lot of credit card debt while only paying the minimum balance.

Therefore, I always recommend everyone to follow a budget. The budgeting strategy I use in particular is the zero-based budget. It gives every dollar from your paycheck a purpose, such as contributing to a mutual fund, building up a down payment, or saving up for an emergency fund.

If you receive a stimulus check, you should put that towards a savings account versus your next Amazon purchase.

How to Transfer Generational Wealth

Estate Plan & Will

An estate plan is a series of legal documents, such as a will, trust, and power of attorney. A Will has instructions on how you want your assets to be managed and distributed.

My husband and I have all our assets assigned to a trust, which allows our children to avoid probate and keep more money. Refer to an estate planning attorney for further legal advice.

Custodial accounts

Custodial accounts are accounts that are in the name of a minor (i.e., your child) but managed by a guardian or parent. The parent can invest and save on behalf of the minor until they reach the legal adult age.

Beneficiaries

Beneficiaries are people assigned to receive your assets in the case you die. Although you may have a will in place, the beneficiaries override those designations.

Why is it Difficult to Keep Wealth Multi-Generational?

Most families lose their wealth by the third generation, also known as the 3rd generation rule. This loss is mainly due to the lack of financial education passed along with the generational wealth.

For the sake of example, I’ll count myself as the first generation. During my time, I acquire assets and teach my children how to be financially wise. After I pass away, my wealth gets passed down to the second generation, my children.

My children, the second generation, also acquires assets using the financial literacy skills I taught them. Unfortunately, they don’t teach their children how to be financially and only transfer their wealth to the next generation, the third generation.

The lack of financial knowledge and understanding of their wealth’s value is the real cause of why families are unable to maintain generational wealth.

Hence, all generations need to educate the youth about personal finance!

Should I Hire a Financial Advisor To Help Build Generational Wealth

Ian Weiner, a Certified Financial Planner, states “Finding an advisor is a little bit science, a little bit art – you need to find someone who is absolutely competent in the basics, we recommend finding a CERTIFIED FINANCIAL PLANNER(TM) they’ll have broad discipline across all areas of planning, which I think is a bare minimum. That’s the science, can they get the job done?“

Danielle Miura, another Certified Financial Planner, shares “A well-educated and trained should be able to dive deeper into your life goals and aspirations. Any financial advisor can tell you what they recommend, but if they don’t understand what you truly need, then the recommendations will be inefficient. Once the client’s goals are clearly determined, financial advisors can create you a path to building your family’s wealth.“

Good news! We’ve developed a course to share with you how we acquired three investment properties in our first 18 months, grossing over $4,000 a month.

SIGN UP NOW AND SAVE AN EXTRA 30 TODAY%!

Conclusion

You don’t have to be a millionaire to start building wealth for your children. Instead, there are multiple ways you can increase your assets and net worth to share and leave behind with one generation at a time.

Overall, the most important thing you can pass along to your children is financial wisdom. Regardless of the dollar value of your assets, your children must value the wealth you give them.

You should set financial goals if you want to leave a legacy. Whether you call it family wealth or family money, it’s all generational wealth!