Emergency Fund Calculator + How to Build One Up

There may come a time when you’ll get hit by an unexpected event, such as a car accident or job loss. It’s beneficial to have an emergency fund prepared to pay for any unforeseen big-ticket items. Fortunately, an emergency fund calculator can help you figure how much you need to be secure.

What is an Emergency Fund?

An emergency fund is a lump sum of money dedicated to unexpected expenses, such as major repairs, medical emergencies, and car accidents. These expenses are not the same as regular monthly bills, such as rent, groceries, and utilities.

For instance, my car’s air conditioner stopped blowing cold air one summer. A small car repair shop quoted it would cost about $2,000 to fix. Initially, I was upset when I heard the estimated price. However, those feelings didn’t last long because I reminded myself that I have a safety net.

Furthermore, an emergency fund should be able to temporarily cover one’s necessary expenses for some time, especially in the case of a job loss. It’s intended to support one’s livelihood while they find a new job.

Depending on how difficult it is to find a new job or how many dependents a person has, it’s crucial to determine how much an emergency fund is needed.

How Much Should You Save For an Emergency Fund?

The amount saved for an emergency fund first depends on one’s monthly expenses. However, these expenses don’t include any “wants,” such as shopping, dining out, or any form of entertainment. Instead, these costs should be basic living expenses, such as utilities, mortgage payment, and fuel.

For example, below is a sample list of monthly necessities that add up to $1,050 a month:

- Rent: $700

- Utilities: $50

- Groceries: $150

- Car fuel: $50

- Insurance: $100

Financial experts recommend an emergency fund amount should be three to six months’ worth of monthly expenses. For the case above, where one month of costs is $1,050, a three-month to a six-month emergency fund is $3,150 to $6,300.

However, the selected period hinges upon one’s lifestyle. For example, a single person with no dependents and doesn’t have a mortgage payment is more suited for a three-month emergency fund.

On the other hand, someone with a family and does freelance work should err on the side of caution and lean towards a six-month or even nine-month size emergency fund.

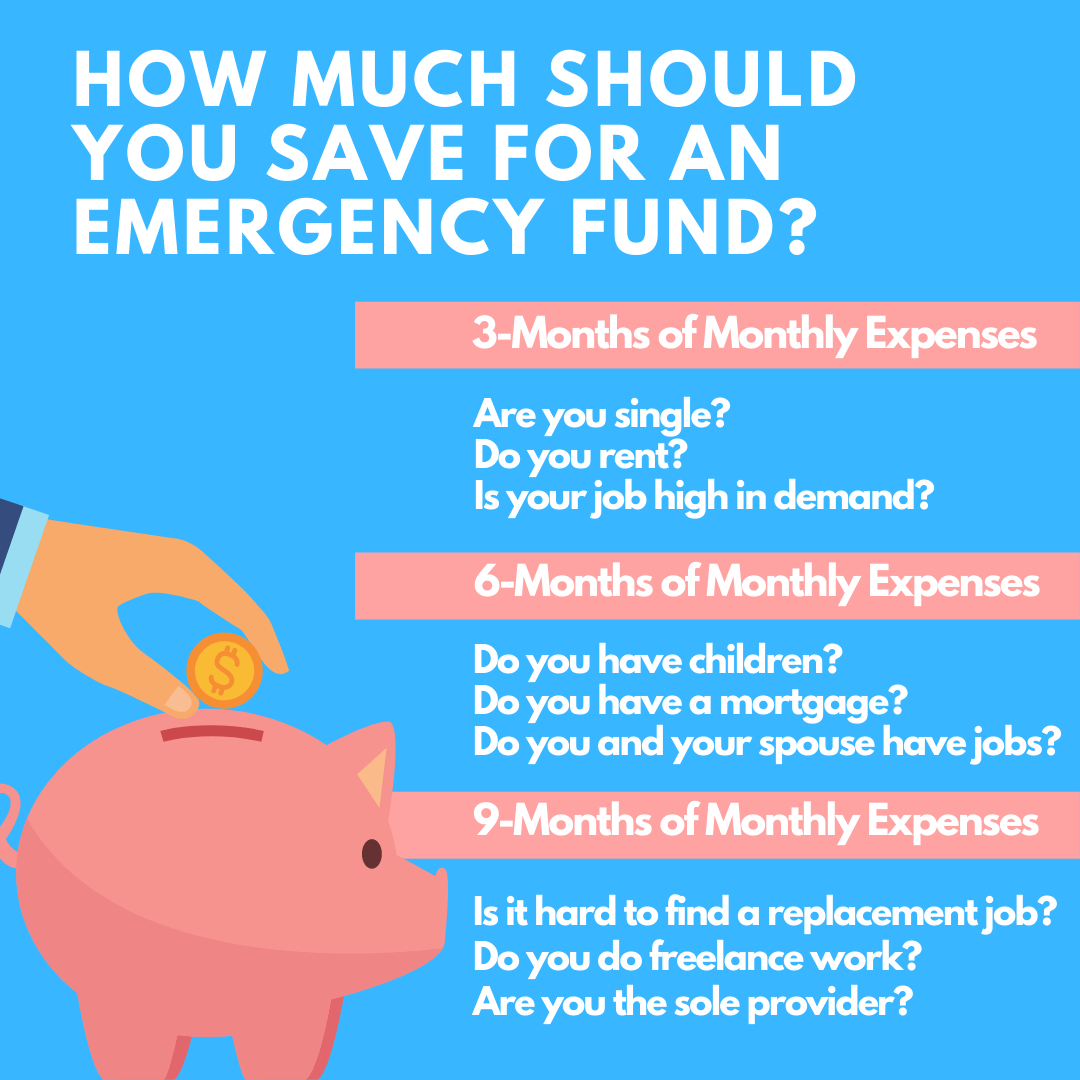

When deciding on how much an emergency fund you need to build up, ask yourself the following questions:

3-Months of Monthly Expenses

- Are you single (i.e., not married)?

- Do you rent?

- Is your job high in demand?

- Do you have a simple lifestyle?

6-Months of Monthly Expenses

- Do you have children?

- Do you have mortgage payments?

- Do you and your spouse have jobs?

9-Months of Monthly Expenses

- Is it hard to find a replacement job?

- Do you do freelance work?

- Are you the sole provider of your household?

Where to Keep Your Emergency Fund?

An emergency fund should be kept in an account that has little to no risk of being lost. For this reason, a high-yield savings account is an ideal place to store your money. It doesn’t need to be the best savings accounts that offer various banking services, such as identity theft and no minimum balance.

Although a high yield savings account doesn’t provide an interest rate greater than stocks, it shields your money from different market conditions and economic downturns.

Storing an emergency fund in investment accounts, such as mutual funds or an IRA, is not safe. Mutual funds depend on the health of the stock market, which can fluctuate throughout the year. Furthermore, some retirement savings accounts charge a fee for early withdrawal from the account.

How Does the Emergency Fund Calculator Work?

The emergency fund calculator collects all your necessary expenses for the month to determine the total. The calculator allows users to adjust their risk tolerance in increments of 3-months to determine the target amount.

Additionally, this savings calculator estimates how long it will take to reach your goal using your current savings amount along with your savings rate.

For example, a person starting with $1,000 aims to have an emergency fund of $3,000. If they have a savings rate of $100 a month, it will take 20 months to reach their goal.

Emergency Fund Calculator

How to Build an Emergency Fund?

Building up an emergency fund depends on you being able to set aside an amount every month from your paycheck, also known as your savings rate (i.e., $200 a month). The higher the savings rate and the current balance, the sooner you can reach your goal.

Therefore, to build an emergency fund, you first need to review your current spending habits to reduce unnecessary expenses and create a budget to contribute to your emergency fund.

Review Current Spending Habits

The first step is to review your current spending habits. I recommend you check the last three months to get a more accurate idea. An online savings account can provide access to your current balance and all transactions.

Identify each transaction and assign it a category, such as utilities, groceries, shopping, rent, etc. After identifying all the categories, differentiate which ones are “needs” and which ones are “wants.“

You may reveal an expense that you forgot a company charges you for, such as a subscription you’re not using. Or, you might realize that you’re spending too much in a particular category, such as dining out.

Identifying these expenses can help you reduce or begin cutting expenses, ultimately increasing your ability to save money.

Create a Budget

After you’ve identified your current spending habits, the next step is to create a budget. The budgeting strategy we use is a zero-based budget. A zero-based budget helps you be more intentional with your money, giving every dollar from your paycheck an assignment.

Whatever money remains after deducting from your paycheck, you can use it towards a savings goal, such as saving for a house down payment, a college fund, and, most significantly, an emergency fund!

For example, a person receives a monthly income of $2,000 and has $1,050 worth of monthly expenses. Therefore, they have $950 to use towards other goals, such as investing in real estate, paying down student loan debt or credit card debt.

With a zero-based budget, all of the $950 needs to have a purpose; Hence, the term “zero-based.” Check out the post “What is a Zero-Based Budget + How I Found $10k” to learn more.

Use the numbers you tracked from your current spending habits to develop a budget for each category. Some expenses are fixed amounts, like rent and insurance, but other costs can fluctuate or be variable, such as groceries.

For variable expenses, set a budget that closely resembles the actual cost. For example, a person who usually spends $80 on groceries can set a $100 budget.

The key is to make sure your budget does not exceed your take-home pay. Otherwise, there is nothing available to save, which means you need to reduce your budget for specific categories or increase your income.

Conclusion

An emergency fund is an essential part of being fiscally responsible. According to Savology.com, only 65% of households in the United States have a dedicated emergency fund.

You’ll often hear financial gurus preach about starting with $1,000 as an emergency fund. In reality, that amount is not much money to barely scratch the surface of significant expenses.

However, the purpose of striving for $1,000 is that it’s an attainable goal. Working towards $1,000 is the first step of building successful personal finance habits. Although it may take some time to build up your target amount, discipline and patience can get you there.