How hard is the Property and Casualty Insurance Test | Expert Guide

If you’re a test taker, you know that some tests are harder than others. You also probably know that the difficulty of a test is not necessarily directly related to its length. Longer tests are easier because the test makers have more time to include tricks and traps that lead you in the right direction. A shorter test may be harder if it requires you to think more and can’t just lead you with little bits of guidance here and there.

The difficulty of any test is subjective, of course, but we’ve done our best to rate this one based on what previous test takers have told us about it. We give our tests labels easy, medium, hard, and challenging to help future users understand what they are getting into before they take it.

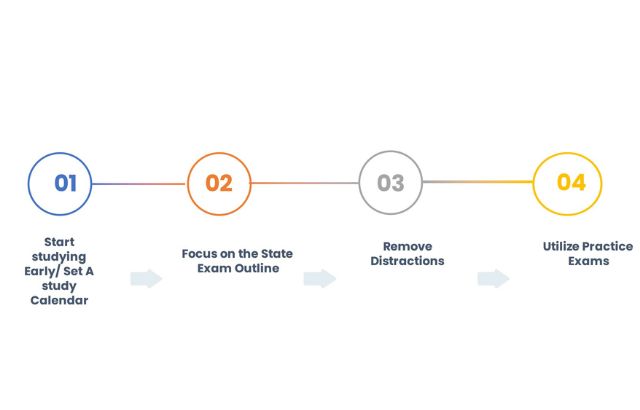

Studying for the property and casualty insurance licensing exam is difficult. It would help if you put in a lot of effort and hard work to prepare, but following these study tips should help you pass the exam the first time. It’s also useful to know what to expect on exam day.

How hard is the Property and Casualty Insurance Test?

It’s not that difficult if you have a solid study plan. For my study plan for both the P&C test and my Life & Health test, I used Kaplan.

Along with a physical book, they provide you with a wealth of online materials, including practice tests and other study aids.

Work hard in your studies and don’t give up if you don’t pass the first time. Once you get into job insurance, there is a tone of various avenues you may go down. It is changing. Good luck if you’re taking the test! I would be pleased to assist you if you have any questions.

What is the Property and Casualty Insurance Test?

A property & casualty license exam is the next step in most states toward acquiring a license. For some states, taking a licensure course is a prerequisite for the exam. All states demand that each agent complete additional education after receiving a license to prepare them for the work. 66% passing rate on the Property & Casualty License Exam, Arizona has the highest overall rating.

When you can expect to sit the Property and Casualty Test

The prerequisites for candidates taking the P&C insurance exam vary by state. These requirements include state-approved exam providers, scheduling and rescheduling fees, license applications, and pre-licensing education.

Many states need to finish a pre-licensing education course before you can take the exam. Each state will have different course requirements in terms of hours.

For instance, to be eligible to register for the insurance exam in California, you must have completed at least 20 to 40 hours of pre-license coursework.

Some states, including Texas and Virginia, don’t demand a pre-licensing course to evaluate your insurance knowledge.

A pre-license course is not necessary candidates in states with no pre-license education requirements are advised to enroll in tuition designed to be ready for the exam. In most cases, they are the only source of the precise knowledge needed to take and pass the exam.

Tips for passing your Property and Casualty Test

How do you take the Property and Casualty Test?

Its multiple choices and many questions include language you might not have during exam preparation. Additionally, many questions have two valid answers, but one is more accurate than the other.

You must carefully read the questions because it is simple to misread and believe the question is asking something different (even when it contains the precise answer to the question you trust you are responding to, leading to many incorrect responses.

There is a lot of information to remember. An excellent memory is required because you cannot study for it half-heartedly without it.

What can affect your property and casualty score?

Location: Everyone will tell you that real estate is about location, location, and location.

Size: Square footage plays an important role when it comes to house prices. The price per square foot in the U.S. is $123, will get more for a house of 4,000 square feet than one 2,000 square foot.

Property comparisons: Your neighbors have a role when it comes to property values. Comps, or comparable properties in your neighborhood that have sold recently, are the key concept here.

When determining the value of your property, realtors and home appraisers use a variety of factors, including these.

Risk-based scoring for property and casualty insurance companies

The future of property and casualty insurance is discussed, with buzzwords like “digitalization,” “cyber risk,” and telematics.

These are significant issues, but they represent the outward expression of danger, namely that in the modern world, property and casualty insurers are losing relevance with their clients.

Three significant shifts in the insurance sector have contributed to the creation of this threat.

Customers’ actions will undergo the first significant change, how they choose to interact with the people, things, and businesses in their life. And it is more complicated than just an online purchase.

The customers’ most prized possessions are becoming increasingly virtual (their images, their music), and their physical possessions and surroundings are becoming more interconnected.

People’s expectations, concerns, and risks—as well as their requirements for insurance—are fundamentally shifting in this society.

Information is the subject of the second transformational change.

There are growing vast influxes of data available about consumers and their genuine behavior.

For instance, a straightforward smartphone app can provide more information about a customer’s driving style than any motor insurance has ever known.

It will be crucial for insurers to figure out how to get these torrents of data and how to interpret them.

Competition is the third modification.

The traditional insurer is now up against new competitors with big brands, client ties, more analytical firepower, and lower costs.

In addition to the well-known “great monsters” of the digital age, such as Google, Apple, and Facebook, these rivals include merchants, utility companies, home service companies, and automakers.

Frequently Asked Questions

What is a license for property and casualty insurance?

When an insurance professional passes the state licensing exam for property and casualty insurance, they give a property insurance license. You can sell property and casualty insurance products, including general liability, worker’s compensation, renter’s insurance, vehicle insurance, and others, if you have a property and casualty license.

Your employer will request your license number and National Producer Number when you apply for a position involving insurance (NPN).

What does a property and casualty insurance license entail?

A property and casualty license may take two to eight weeks to obtain.

Each state has its own set of licensing requirements.

- Some states need a pre-licensing course, but other ones do not. Studying for the test need more time, even if your state does not mandate a pre-licensing education course.

- After you pass the exam, the insurance regulator in your state will examine your application, which could take a few days to a few weeks.

- You will be informed and given a copy of your official insurance license.

Which career is available to me with a property and casualty license?

With a property and casualty license, you can work in different positions.

In addition to becoming an agent or broker, other possible careers include insurance adjuster, underwriter, examiner, manager of personal or commercial lines, manager of operations, and insurance specialist.

Is the test for property and casualty insurance challenging?

The pass rate for property and casualty insurance is 54.9%, according to the National Association of Insurance Commissioners (NAIC). You can study diligently for weeks before test day and take an exam preparation course to help you ready and pass the test.

Conclusion

Most states require a passing score of 60% on the property and casualty exam. The passing rate for property and casualty insurance is 54.9%, according to the National Association of Insurance Commissioners (NAIC).

It is hard to pass the property and casualty exam, but you can get ready by taking an exam preparation course and creating a solid study plan.

You can repeat the exam if you fail it twice, then wait at least 60 days before doing so. Associated with taking the exam, so prepare thoroughly before your first attempt.