How to Pay Property Tax Online | Step by Step Guide to Pay Tax Easily

The property tax is for the property owned by an individual or another legal person. Taxes are the primary source of income for governments. The property owner must pay taxes for their tangible property like residential homes, offices, and property rented to a third party. There are two methods to pay property tax, part of the monthly payment or directly to the local tax office.

Property taxes are payable to the local government and have specific methods for paying property tax online companies have portals to pay tax online, which is an effortless way instead of going to the tax office to pay tax.

With the innovation of the technology and facilities turning into requirements, first, we need electricity to run the service for paying property tax online. Every work runs through electricity, makes things easy, and supplies safety and security.

Similarly, this proposal is for how to pay property tax online. Local governments collect property taxes that will help pay for facilities and projects that run the society.

Online payments play a vital role in the security and surveillance system of countries. For paying property taxes online, visit the official website of your local government, and log in with credentials.

You must register on the portal when you do not have a login, then select the tab property tax and go forward for the details such as property owner details and property identification number. The owner of the property must fill other requirements.

Who Needs to Pay Property Tax?

Those who own property need to pay taxes, which ensure that the local government is funded sufficiently for the year. On the other end, the property tax collected from an individual or business property and net worth is also the type of property tax.

They offer property owners convince of receiving their tax bill and paying it online. Payment of tax before the due date entitles your discount.

Property owners must pay taxes each year according to the rules and regulations of countries. The owners go through an assessment by a systematic process that specifies the value to all the property owners according to their possessions, every individual who owns the property, including individuals, industries need to pay the tax decided by the law, and it is compulsory.

The purpose of taxation in a country is to create (funding for) a public service. Every year government mails a tax notice to each assessed owner notice will explain all the processes of how to do it.

Renters are not responsible for the tax. It is the landlord’s responsibility to pay the tax to the government.

Note: Only land and improvement include in the assessment. Improvements include buildings, mobile units, pipelines, works, and transmission lines. Property such as jewellery, cars, televisions, and other personal possessions is not in the assessment.

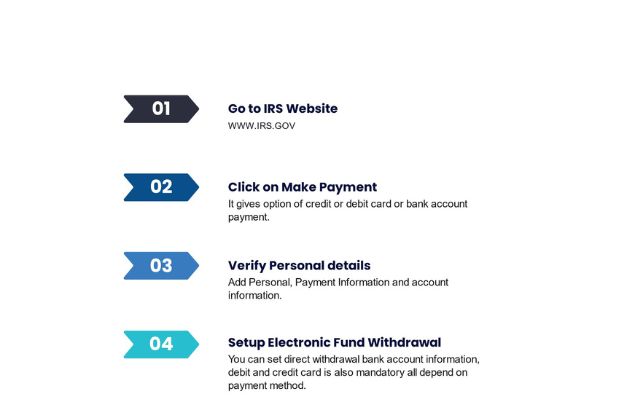

How to Pay Property Tax Online in the USA?

- Visit the IRS website.

- Register on the portal login with credentials www.irs.com portal.

- Click ‘property tax’.

- Select property type and assessment year

- Select make a payment.

- Verify your details such as name, property identification number, and other relevant information

- Choose your mode of payment and complete your payment

- For online payment, debit and credit card is mandatory

- Download or print the receipt for reference

How to Pay Property Tax Online in the USA | More Ways

Paying Property Tax Online with Scan able Check or Electronic Funds Transfer

Electronic Funds Transfer is a non-paper, computer-to-computer transfer of funds from a taxpayer’s account to the treasury account. Electronic fund transfer is a more efficient and less expensive payment choice than a paper transaction.

Paying Property Tax Using e-Check or Electronic Funds Transfer (EFT)

Digital movement of money from one bank to another you can use when you want for payment of your federal taxes with the help of tax preparation software or a tax professional.

Online tax payment using a credit or debit card.

It is an effortless way to pay taxes through credit or debit card, but you must check with the local tax collectors that your country has the facility of credit or debit card for payment of taxes.

People pay their property taxes through cash (or bank transfer) because credit or debit cards need service fees. Both companies take money to process the transaction.

Online using an electronic check payment (eCheck)

In an online electronic check, payment is through creating a digital check-up on the payer’s authorization payment, a digital check generated upon the payer’s authorization. Individuals who use E-check for paying taxes will receive a receipt that can save as a pdf file.

By telephone using a credit or debit card

We can pay property taxes online or over the phone using PayPal (digital wallet). Paying tax using a debit or credit card is easy. Online tax software lets you pay your tax. Using credit cards and debit card is more secure and safe because commercial card networks are in use.

Where to Pay Property Tax in the USA?

A vast number of methods to pay property tax E-check or electronic check which does not have any cost and echeck holds Assessor’s identification number (AIN) and personal identification number (PIN) for transaction and limit for transaction on echeck is $999,999.99.

Credit cards and debit cards are also payment methods of tax. We need the Assessor’s identification number (AIN), printed on your property bill, to complete the transaction.

Your secured property tax bill holds your Assessor’s Identification Number (AIN) to help you complete the transaction.

Property tax payment deadline in the USA

Predictably, tax payments are on quarterly tax dates: April 15, June 15, September 15, and January 15 of the year 2022 in the United States.

Is it safe to pay tax online?

Yes, it is safe and secure to pay tax online using online payment methods. No one will find your property ID when you make tax payments online at home.

All you do is keep your ID and give your details accurately to process online payments. A security method already defined and implemented internal security policies where only you can process and cancel your payment.

How much does it cost to pay property tax online in the USA?

If the payment of tax is $50 then, the debit fee is $2.55 and, the credit fee is $2.69. If the tax is $250, the debit fee is $2.55, and the credit fee is $4.96. It varies taxes vary in each state every year. Median property taxes range from $587 in Alabama to $8300 in New Jersey.

Taxes vary based on the state’s tax rate, deductions, credit, and everything beyond you will pay a minimum of $60 to $49 per state for electronic payment and filling.

What are the benefits and drawbacks of paying property tax online?

Depending on the property, property owners must make an annual tax payment report to the government.

Advantages of paying property tax online:

Supplementary income for the country’s government property tax makes sense from an equality perspective. It will improve the social structure of society. Property tax is a reasonable load for most property owners.

Countries launch projects using taxes, like investing money in education, health care, technological progress, and improved safety levels. With property taxes, welfare programs are also running.

Paying property tax using online software improves speed, accuracy, and simplicity since you do not need to print and mail paper forms. Moreover, the benefit to the government is they can receive funds from the public. Whereas its advantage for people is taxes are divided between people equally.

Disadvantages of paying property taxes online

Include technology issues that may occur during the filling process.

Frequently Asked Questions

Is this mandatory to pay tax online?

It is viable that you must quite up proudly owning the property by paying the taxes. Each country has different methods to pay taxes online using electronic checks, debit and credit card payments, and bank account payments. The authorities oversee the sales.

How do I pay my property tax?

There are two ways to pay your property tax bill, monthly mortgage payment and directly to the local tax office. Payment in person, cash, debit/credit card, or you can use software and websites, and bank account payments are ways to pay your tax.

How to pay land tax online?

Pay your land tax online on the municipal body, or you can download the app of the municipal body on a smartphone. Land tax payments are online, using your property ID and PIN allocated to individuals. You can also pay taxes using net banking, debit/ credit card, and mobile wallet.

How to calculate property tax?

To calculate the property tax value, multiply the assessed tax value by the rate. Property taxes apply to assessed values, and the rate varies according to location. The standard Californian tax rate is 1% residents pay the percentage of their property value. If it looks complicated, you can avail of a professional tax service, which is errorless in filling repayment.

Where to pay property tax by credit or debit card?

Apart from paying via software, you can pay property tax using your cards. The transaction limit is the same but includes a service fee of 2.22% of the transaction amount. Use your PIN on your unsecured property tax bill.

You have the option to pay 24 hours a day. People do not use debit/ credit cards because of service fees. Online payment is more secure.

When is property tax due in California?

Due to tax in California, it has two installments. The first installment of secured property taxes is due November 1 and beyond December 10. The second due date is February 1 beyond April 10, and the deadline for property tax is December 10 and April 10, do not confuse it with IRS. You should subscribe to e-notifications to avoid missing the deadline. Taxpayers can pay both installments together during the first due.

Which states do not have taxes?

The United States enables the ability to differentiate how it generates revenue through taxation. It has nine states that pay tax but not at the state level, Wyoming, Washington, Texas, Tennessee, South Dakota, New Hampshire, Nevada, Florida, and Alaska.

Is property tax part of the mortgage?

Yes, property tax is part of the mortgage. The owner’s monthly payment includes 1/12th of the annual property taxes. But lenders manage their taxes by using escrow account and filling it with monthly payments. Lenders keep the tax bill secure for their investment.

If any government claims for due property taxes, it must be paid from foreclosing sale if they foreclose on your property.

Conclusion

Payment of taxes is essential in every country. Residents of every country must pay taxes. If we do not pay our property tax, it will affect the stability of our country. Property owners should not avoid paying taxes because it may affect the country’s economy and services.

Without taxes, the government would be unable to meet the requirement of society. The sectors of health, education, and public security could be one of the most deserving recipients of tax money. Every resident of a country should pay taxes before reaching the deadline.

Personal Opinion

When we are residents of any country, we must follow the rules and regulations given to us by the government. We can at least do paying taxes to the government. We must pay property taxes before the deadline. There is multiple online software available to pay tax online.

There is some critical information that property owners need to understand about their property tax. Following this document will help you know how to pay your property tax online and the due date and calculation process. If you are not familiar with tax procedures, you can consult with a professional tax for assistance.

References:

- https://www.investopedia.com/how-to-pay-your-property-tax-bill

- https://taxsaversonline.com/do-you-have-to-pay-property-taxes-forever/

- https://taxfoundation.org/oecd-tax-revenue-2021/#Types

- https://www.ttb.gov/tax-audit/tax-payments-by-eft

- 28 Key Pros & Cons of Property Taxes – E&C (environmental-conscience.com)

- https://business.ebanx.com/en/resources/payments-explained/electronic-funds-transfer-eft

- https://ttc.lacounty.gov/pay-your-property-taxes/

- How Long Does It Take the IRS to Release Your Refund? (pocketsense.com)

- FAQs On How To Pay Property Tax Online In 2022 (jarrarcpa.com)