How To Get A Mortgage Refinance Without A Job

The general rule with respect to home mortgage is to always refinance when interest rates drop. But can you get a mortgage refinance without a job and if yes, how difficult is the process?

As long as you match the duration of the loan, and do a no-cost refinance; you will come out ahead. The no-cost refinance loan ensures you have no closing cost. And the break-even point is easy to calculate.

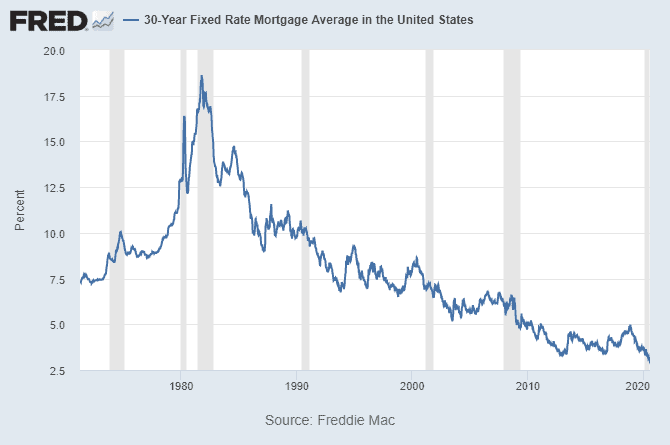

Mortgage rates have now dropped to a record low. The 30-Year Fixed Rate Mortgage is below 3% as per the St. Louis Fed

My paid off primary home is one of my largest asset. Due to the large equity in my primary home, I have been exploring options for Cash Out Refinance. This year, my method of investing in Moonshot Companies has yielded amazing results. And I want to juice my returns.

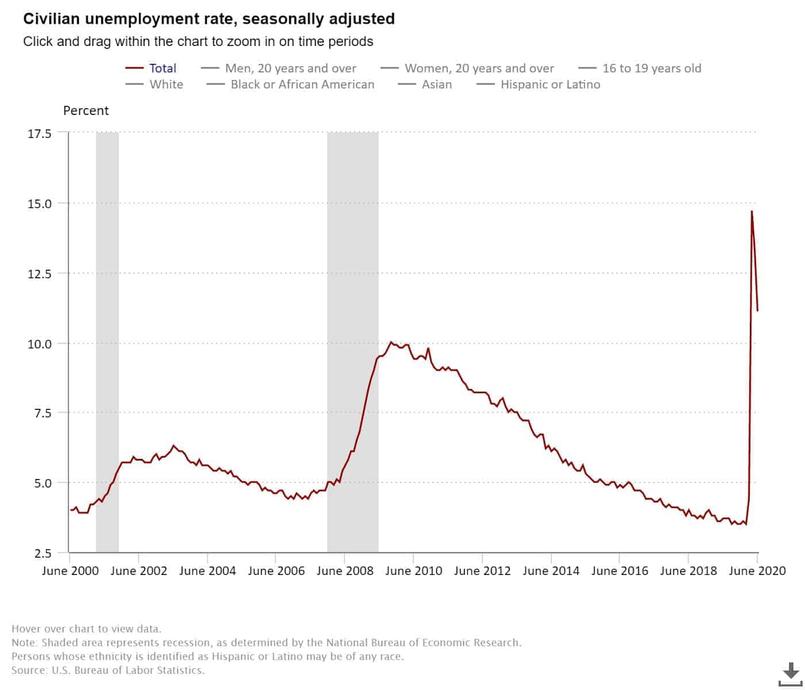

On one hand we have record low interest rates; but on the other hand, we are having record high unemployment. As per, the US Bureau of Labor Statistics, the unemployment rate is at record levels.

Low mortgage rates combined with high unemployment has led to a peculiar situation. The current low rates are as result of actions taken by the FED based on economic conditions. If you are waiting for the economy to improve and get a job; will mortgage rates continue to remain low?

While several Coronavirus mortgage relief measures are in place; there are none for individuals who want to refinance and lower their monthly mortgage payment.

I am sure a lot of individuals are wondering how can I refinance a mortgage with no job? Refinancing without proof of income is not easy.

Can You Refinance While On Unemployment?

In most cases, you cannot refinance your house if you are unemployed.

For tax purposes, unemployment income is counted as wages. But it cannot be used for refinancing; except in the narrow case of seasonal workers.

Seasonal workers as the name implies work only during certain times of the year. For example fishermen who fish during a particular season, ski operators. Even Santa Claus can be considered a seasonal worker

A seasonal worker, can document that they received jobless payments consistently for at least two years and be considered for a mortgage. And the lender must verify that the seasonal income is likely to continue. Refer to the specific guidelines for Federally backed loans by Fannie Mae and Freddie Mac.

ACTION STEPS: If you are a seasonal worker, get the previous 2 years tax returns from the IRS. Make sure it documents the seasonal payments received.

Family member To Co-sign

As long as you have a family member willing to co-sign; this should be a fairly easy method to refinance. Main challenge is having a co-signer agree. Because they would be responsible for the mortgage in case of non-payments.

Also, they should have enough income so the debt to income (DTI) ratio is met.

ACTION STEPS: Check if you have a willing family member to co-sign. If so, get copies of all credit reports and make sure you meet the 45% DTI ratio.

FHA Streamline Refinancing

The FHA streamline refinance is ideal for homeowners with an FHA loan currently; and want to reduce their payment.

The FHA streamline does not need income verification. You may be required to prove you are still working, but the income from that job need not be verified.

And, no appraisal is required. If the home has lost value, the lender can still approve your refinance. The Federal Housing Administration allows you to use your original purchase price to represent your home’s current value. You also have the option, to use a current appraised value.

As per HUD, the basic requirements of a streamline refinance are:

- The mortgage to be refinanced must already be FHA insured.

- The mortgage to be refinanced must be current (not delinquent).

- The refinance results in a net tangible benefit to the borrower.

- Cash more than $500 may not be taken out on mortgages refinanced using the streamline refinance process.

ACTION STEPS: Check your HUD-1 statement (closing statement to your original mortgage loan) to confirm if you have a FHA loan. If you can’t find your HUD-1 statement, contact your lender, escrow company or your current loan servicing company.

Asset Based Mortgage Refinancing

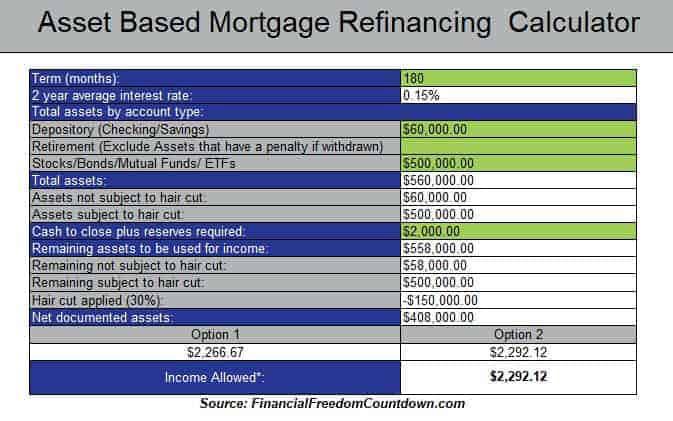

Asset based mortgage refinancing lets you refinance without a job. The lender calculates income based on the assets you have. And uses that as the basis to determine if you qualify for the refinancing.

What Assets Can Be Included For Asset Based Mortgage Refinancing?

Different lenders have various requirements but at a broad level;

- Only liquid assets can be included. So besides cash, you can also include publicly traded stocks, bonds, ETFs, mutual funds, etc.

- You cannot include private investments.

- If you have lent money to others, either directly or via crowd funding; those funds can’t be included.

- Roth contributions made more than 5 years ago can be included.

- Roth earnings can’t be included

- IRAs and 401(k)s cannot be included if you are not over the retirement age.

How Is Income Calculated From Assets?

- All stocks, ETFs, mutual funds undergo a 30% haircut. The lender assumes that the market could drop and accordingly considers it at 70% value.

- Lenders generally use asset depletion model. The entire assets are assumed to be depleted over the lifetime of the loan to repay. See Option 1 in the example below.

- Some lenders are generous and will ascribe a growth rate to your assets. Unfortunately, the growth value is 2 year average interest rate. While stocks have returned roughly 10% over the last decades; lenders will be conservative. See Option 2 in example below.

Asset Based Income To Refinance Without Job

The lender will want the “income” from assets to cover not only principal and interest; but also taxes and insurance.

Income has to be at least 2X all proposed debt. Lenders want less than 45% debt to income ratio.

Summary Of How To Refinance Mortgage With No Job

Needless to say, with any refinance it helps to have a high credit score and no delinquent debt. In fact, I would pay off the balance on any outstanding debt including credit cards so the only debt is related to the mortgage. Check your credit score for free using Credit Karma.

In case you were wondering “can I refinance my home if I lost my job”, there are options.

- Seasonal workers can use unemployment income based on the last 2 years tax returns.

- If you have FHA loan currently and want to reduce their payment, look into FHA Streamline program.

- Find a co-signer with regular documented income.

- Use your assets to get an asset backed mortgage.

This article is originally from Financial Freedom Countdown.