What is Mortgage Insurance + How to Avoid It

Congratulations! You got your offer accepted on your first house, and you will close on your property in a few weeks. The bank sends you documents with an estimated mortgage payment. But, you are stunned by the amount and ask, “What is mortgage insurance?”

Many first-time homeowners (myself, included) assume it’s cheaper to own a house than renting one. They only focus on the purchase price but don’t consider the factors for owning a home.

Some of these factors include property taxes, home insurance, maintenance, and mortgage insurance!

What is Mortgage Insurance and Why Do I Need It?

Mortgage insurance (MI) is an insurance policy for lenders that a mortgage insurance company will pay the lender if a borrower defaults on their mortgage (i.e., stops making mortgage payments). Lenders often interchange the term mortgage insurance with private mortgage insurance (PMI).

This insurance policy is different from a homeowner’s insurance policy. A homeowner’s insurance policy protects the borrower if something catastrophic happens to the property, such as a fire or a damaged roof. In contrast, mortgage insurance works in favor of the lender.

Lenders require mortgage insurance for borrowers who can’t make a down payment of 20% of the home’s purchase price. Mortgage insurance makes lending less risky for a lender!

Unfortunately, the borrower is responsible for paying the mortgage insurance premium! Furthermore, this premium does not help pay off the loan nor protect anyone from foreclosure.

Hence, the lender is the one who mainly benefits from mortgage insurance.

The borrower is already paying interest for the mortgage loan and is the one to pay mortgage insurance. The only benefits to the buyer are that they can live in a house sooner before saving up a 20% down payment and acquire a lower interest rate.

Types of Private Mortgage Insurance

Borrower-Paid Mortgage Insurance

Borrower-paid mortgage insurance is the most common private mortgage insurance. The borrower is responsible for paying the insurance premium on top of their monthly mortgage payment.

Single-Payment Mortgage Insurance

Unlike borrower-paid mortgage insurance, single-payment mortgage insurance does not separate the premium among the mortgage payments. Instead, it is an upfront mortgage insurance payment that can be paid in full during closing or tied into the loan.

Split-Premium Mortgage Insurance

Split-premium mortgage insurance is a split between single-payment mortgage insurance and borrower-paid mortgage insurance.

Borrowers must pay a portion of the insurance premium in one lump sum, like single-payment mortgage insurance, and then pay the rest of the premium across mortgage payments. Paying a portion upfront will effectively reduce the monthly insurance premium.

Federal Home Loan Mortgage Protection

Loans that are insured by the Federal Housing Authority are also known as a Federal Housing Administration (FHA) mortgage loan. The government guarantees the loan and not a mortgage insurance company.

The FHA passes mortgage insurance costs to the borrower by implementing a Mortgage Insurance Premium (MIP). A MIP is similar to split-premium mortgage insurance, where an upfront guarantee fee is required and additional monthly payments.

However, unlike split-premium mortgage insurance, the monthly premium for a MIP is not reduced!

Lender-Paid Mortgage Insurance

Lender-paid mortgage insurance is when the lender takes on the responsibility of paying the PMI.

However, lenders counter paying the premium by charging a higher interest rate on the mortgage loan. Hence, the borrower is still paying mortgage insurance, but indirectly!

Is Mortgage Insurance Based on Credit Score?

The two factors determining the annual mortgage insurance premium are the loan balance and the mortgage insurance rate.

The amount of a buyer’s down payment and their credit score will affect their mortgage insurance rate. A buyer with a low credit score will receive a higher rate.

How to Avoid Paying Mortgage Insurance?

Pay 20 Percent Down Payment

The way homeowners can avoid paying mortgage insurance from the start is by making a 20% down payment when they purchase their home.

For example, a potential homeowner wants to buy a $300,000 home. Therefore, they need to pay $60,000 ($300,000 x 20%) to make a 20% down payment.

The principal balance of the loan will be at least $240,000. This balance doesn’t consider closing costs. The buyer can pay for the closing costs before acquiring the house or include them as part of the loan.

Make Extra Payments

If a homebuyer cannot make a 20% down payment, the next option is for a homeowner to own 20 percent equity in their property. Equity is the “home’s original value” minus the principal balance of the loan.

Home Equity = Home’s Original Value – Principal Loan Balance

Once the homeowner has met the 20% requirement, the monthly mortgage insurance must automatically cancel from the monthly mortgage payment. A person usually will have to wait 11 years with regular payments to reach this milestone.

Therefore, a homeowner can accelerate paying down the loan by making an extra payment towards the loan principal. By making one additional mortgage payment, the term can be by 5 to 7 years!

Some lenders will honor the home’s market value instead of just the home’s original value. With rising home values, this approach can be favorable to a homeowner.

However, an appraiser will need to confirm the market value of the house, which will be an expense paid by the homeowner.

It’s essential to note that this method does not work with FHA mortgage insurance. A borrower with an FHA is required to wait 11 years regardless of the equity in the home. The only way to get rid of a PMI with FHA home loans is through a refinance.

Refinance

A mortgage refinance is when a lender replaces an existing mortgage loan with a new conventional mortgage loan. Refinancing is a great way to save on interest and time and remove the PMI.

Instead of waiting for 11 years or making additional payments, a borrower can take advantage of their home’s appreciating value to avoid mortgage insurance. The borrower must have at least 20% equity in their home!

A lender will use the home’s market value to calculate the loan-to-value (LTV) ratio. If the LTV is less than 80%, then a PMI is not required.

Loan-To-Value Ratio Formula = Current Loan Balance / Home’s Market Value

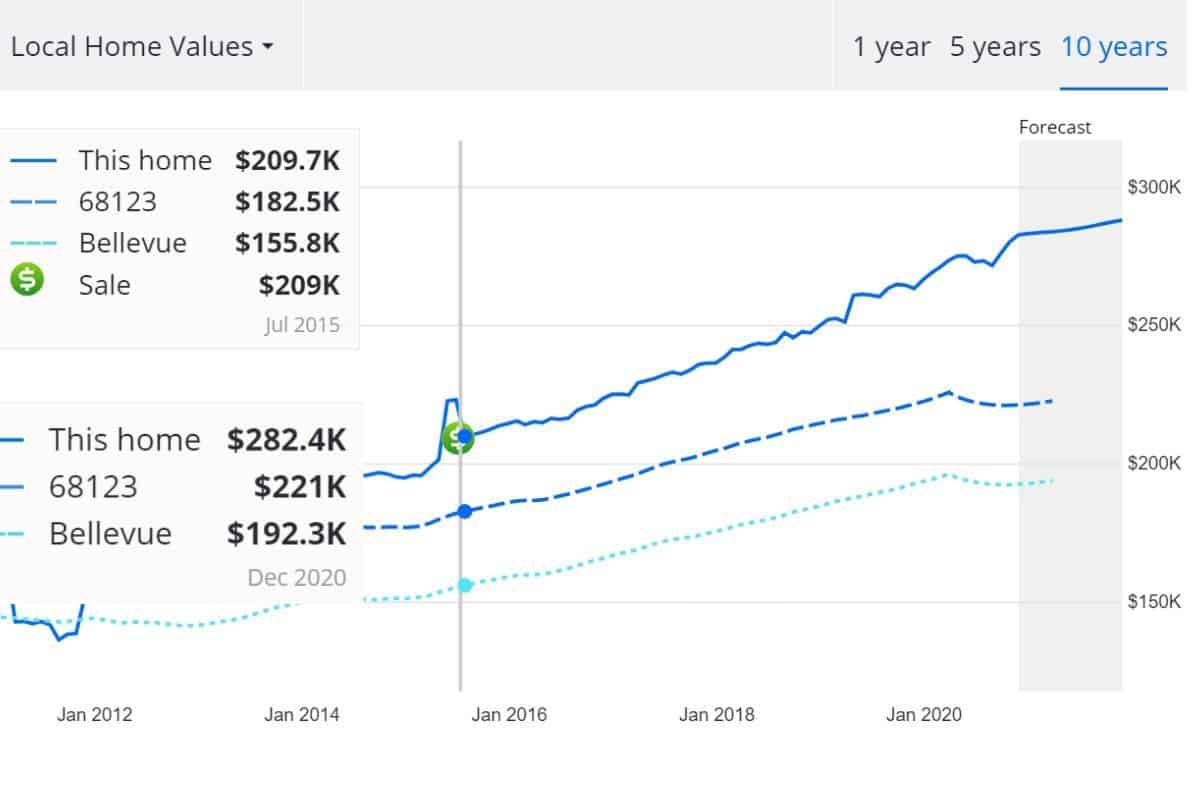

For example, a homeowner purchases a property for $209,000. After five years, the property’s market is $282,000. The LTV is 74% ($209,000 / $282,000). Therefore, a refinance would drop the PMI.

The essential thing to consider with a refinance is the closing costs. Paying closing costs would require a homeowner to stay in their property for at least a certain period to justify the expense. Therefore, sometimes it’s more cost-effective for a homeowner to make additional payments towards the principal balance.

VA Loan

A VA Loan is for U.S. military service members, veterans, and surviving spouses. The FHA also guarantees this kind of loan without requiring mortgage insurance.

Another benefit of a VA Loan is that it requires no money down from the borrower. However, there is a one-time VA funding fee with this kind of loan.

How Real Estate Investors Avoid Mortgage Insurance

For non-occupied investment properties, lenders require about 20% to 25% of a down payment of the purchase price. This sizable down payment is not necessarily for avoiding mortgage insurance.

The high down payment is also an upfront guarantee from the investor since they will not be the one to occupy the property. The removal of the PMI is a happy side-effect!

Investors leverage other assets or other people’s money to make down payments on multiple investment properties.

To learn more about leveraging other people’s money, check out this article 4 “No Money” Ways to Invest In Real Estate.

Investors also utilize the BRRRR method to refinance their mortgage, which is a strategy that allows them to scale their real estate portfolio. In less than two years, I acquired three investment properties with this strategy.

Conclusion

Mortgage insurance protects the lender but is an expense to a borrower. Homeowners can remove the PMI by making additional payments toward the loan’s principal balance or by refinancing.

After five years, I took advantage of my home’s increasing value to refinance my mortgage loan. Not only did I stop making mortgage insurance payments, but the new loan reduced the term by five years!

I’ve also redirected the amount that was used for PMI to go toward the principal balance. These extra payments reduce my term by additional four years. Therefore, I shortened my term by nine years and saved over $50,000 in interest!