5 Best Performing Stocks And What To Buy Now

2020 was a weird year for the world economy. Even more surprising has been the impact of the economic fallout on the stock market. It was a year when expensive stocks grew even more costly. Given the high unemployment rate and the fall in GDP, everyone expected the stock market to crash. Yet, the markets bounced back and are higher than the pre-pandemic levels. Professionals and amateurs were equally surprised at the stock market performance and the list of best-performing stocks last year.

Why Did The Stock Market Perform Well

Before we dive into the best-performing stocks, let us understand what was so different about the last year. Although the unemployment rate skyrocketed to the highest levels since the great depression, most white-collar jobs were unaffected. The ability to work from home resulted in many jobs being saved. The usage of technology to solve the current crisis also resulted in earnings getting pulled forward several years.

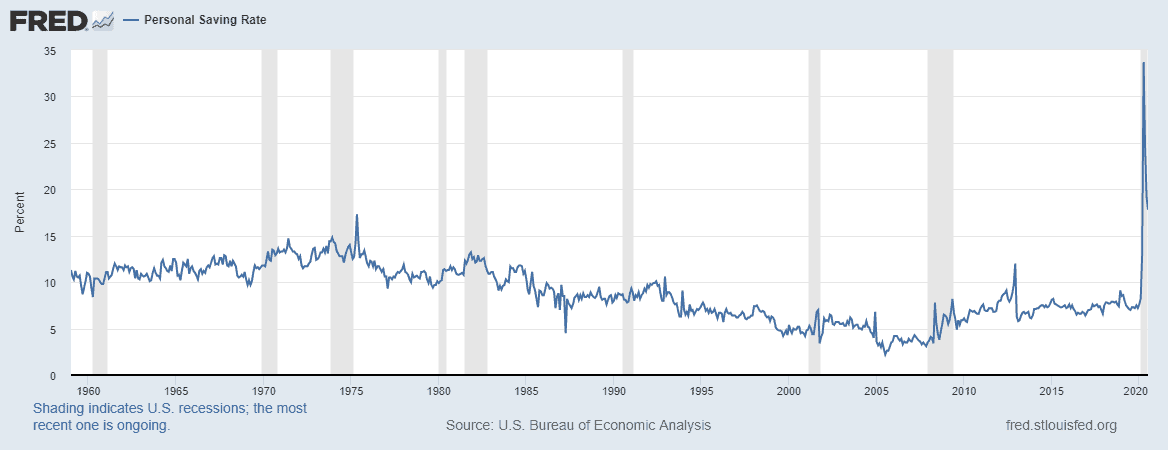

The Federal Reserve, the Treasury, and Congress worked together to provide stimulus packages to various affected communities. While we can debate the speed and effectiveness of these measures, the data clearly showed that the vast majority of Americans could use the funds to augment their net worth. The Personal Saving Rate shot to an all-time high of 33%. As per the data released by N.Y. Fed, total household debt decreased in Q2 2020, marking the first decline since 2014

Best Performing Stocks in Nasdaq for 2020

The Nasdaq list of best-performing stocks encapsulates how everything changed in our lives during 2020.

Zoom became part of our everyday vocabulary as everyone started working from home, and all events were conducted virtually. Closure of gyms resulted in people working out at home using Peloton. Moderna using their mRNA technology took only six weeks to devise and manufacture initial lots of its vaccine.

Any list of best-performing stocks of 2020 would be incomplete without Tesla. The stock had a meteoric rise in 2020, capturing everyone’s imagination. The stock price increase propelled Elon Musk as the world’s wealthiest person, overtaking Jeff Bezos and Bill Gates.

| COMPANY | TICKER | PRICE CHANGE |

| Tesla Inc. | TSLA | 743% |

| Moderna Inc. | MRNA | 434% |

| Peloton | PTON | 434% |

| Zoom Video | ZM | 396% |

| Pinduoduo Inc. | PDD | 370% |

Best Performing Stocks in S&P 500 for 2020

When we look at the best-performing stocks in the S&P 500, we have Tesla at the top of the list again. The inclusion of Tesla into the S&P 500 was not without controversy. By far, Tesla was the largest firm by market value ever to join the S&P 500.

Tesla’s inclusion in the S&P 500 forced all the index funds that track the S&P to purchase tens of billions of dollars of Tesla stock in a bid to track the index as closely as possible. As a result, the stock spiked higher in price to a self-fulfilling prophecy.

Tesla’s impact on index inclusion was a real outlier. Usually, stocks are added at a much lower market cap, and it would not impact the index to such an extent. As per the S&P 500 committee rules, a company must report an accumulated profit over four consecutive quarters. Tesla turned profitable only recently. However, the stock price had risen a lot higher even before it started making money.

| COMPANY | TICKER | PRICE CHANGE |

| Tesla Inc. | TSLA | 743% |

| Etsy Inc. | ETSY | 302% |

| Nvidia Corp. | NVDA | 122% |

| PayPal Holdings Inc. | PYPL | 117% |

| L Brands Inc. | LB | 105% |

Best Performing Stocks Based On Lifetime Wealth Creation

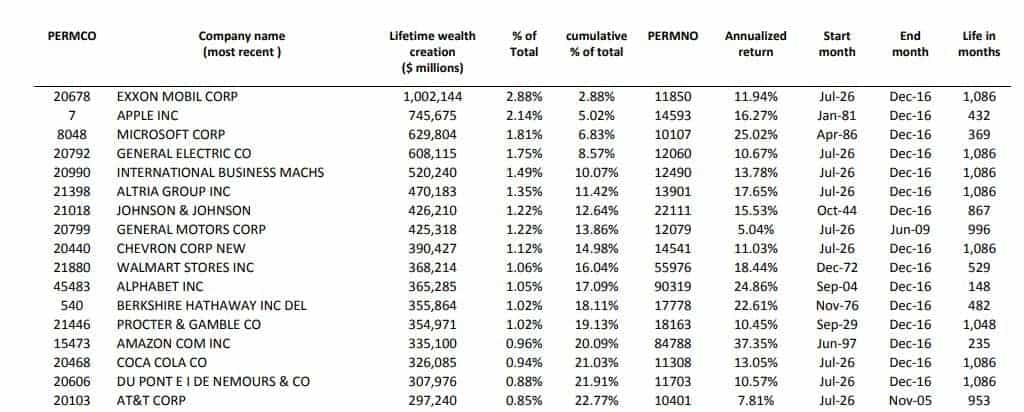

According to the SSRN paper “Do Stocks Outperform Treasury Bills?” authored by Bessembinder, ExxonMobil (Ticker: XOM) created a staggering amount of $1 trillion in wealth between 1926 and 2016. It has been one of the best lifetime wealth creation machines. Undoubtedly, Exxon’s reliable dividend has paid out to shareholders since 1882 has contributed to its remarkable performance. ExxonMobil has been part of the Dow since 1928 and has rightfully earned its place with the wealth creation over generations.

Best Stocks To Buy Now

It might be tempting to look at the list of best-performing stocks to extrapolate that their performance would continue. However, past performance is not indicative of future performance. Picking individual stocks is hard, even if they have been the most successful stocks in the past.

Ironically, ExxonMobil was removed this year and replaced by Salesforce (Ticker: CRM). The WTI futures contract turning negative did not help ExxonMobil’s cause either.

If ExxonMobil’s fate did not convince you that stock picking is not a great idea, let us deep dive further into Bessembinder’s research. He found that most common stocks that have appeared in the Center for Research in Security Prices (CRSP) database since 1926 have lifetime buy-and-hold returns of less than one-month Treasuries.

Yes, you read that right. Holding the majority of individual stocks would be a losing proposition, and you would be in a much better position, just putting that money in safe and secure treasuries.

If you wonder how to reconcile this underperformance with the data that stocks outperform treasuries, the answer lies in a tiny subset of stocks. When stated in terms of lifetime dollar wealth creation, the best-performing 4% of listed companies explain the entire U.S. stock market’s net gain since 1926.

In simple terms, only a small subset of listed stocks is responsible for most of the wealth creation in the overall stock market. Those are the real A+ players. The other stocks were true laggards.

The outperformance of this tiny elite group of stocks is such that it compensates for most other stocks’ underperformance.

“The results reinforce the importance of diversification, and low-cost index funds are an excellent way to diversify broadly.”

Hendrik Bessembinder, Arizona State University’s W. P. Carey School of Business

Advantage Of Index funds

Bessembinder’s study is an excellent example of why index funds are a better choice for everyone. It is fun to look at the best-performing stocks and dream of picking the next Tesla or Amazon. However, it is hard to pick the winners in advance.

A better alternative to looking for the needle in the haystack is to buy the entire haystack. No one would have anticipated the company would survive or even reach the current valuation levels looking back at Tesla.

I have a small allocation of fun portfolio used for moonshot investing to pick individual stocks. But my assignment to my moonshots is such that even if it goes to zero, I would be fine. Define your risk tolerance and stick with your investment plan without getting swayed by the best-performing stocks because the best performing stock of last year could drop in value tomorrow.

Most of my net worth is concentrated in low cost diversified index funds. Instead of trying to time the market and determine if it is an excellent time to buy or sell stocks, I just auto-invest. My asset allocation is defined, and my investment platform periodically invests my funds and auto rebalance as needed for free.

I understand why looking at the stock indices at an all-time high might make you nervous. However, sitting in cash is not a winning strategy. As 2020 has demonstrated, you can analyze all the economic indicators and conclude that we should be in a recession. Yet stocks could march higher and higher.

If the volatility of stock markets makes you nervous, the best course of action is to examine your asset allocation. Define your asset allocation between stock and fixed income. Run the numbers using the best retirement calculators to figure out when to retire and how much you need. Or, use a Forex Compounding Calculator when necessary.

If you want to reduce your stock investments due to volatility and the bond portfolio does not provide returns, look into asset-backed securities that offer higher returns, like farmland investing. While you do not get the safety of U.S. treasuries, you do get higher returns.

Final Thoughts On Best Performing Stocks

Analyzing the list of best-performing stocks to determine if they would continue their outperformance is hard. Although momentum and trends persist for a while, using those factors to base your investment doesn’t always work out.

We have seen how one of the highest wealth-creating stocks in history, such as ExxonMobil, also recently fell out of favor.

The prudent course of action is to allocate the bulk of your portfolio to boring low-cost index funds that track the market. Have a small, fun portfolio if you want to pick individual names but be prepared to lose all value. And if the volatility of investing in stock markets makes you nervous, then invest a portion of your portfolio in hard, tangible asset-backed securities.

This article originally appeared on Wealth of Geeks and has been republished with permission.